Unlock Burrito Day - Your Home's Sweet Treat

Imagine a day where everything just feels a bit lighter, a moment of pure, simple happiness. That's the kind of good feeling we're talking about when we think of something like "Unlock Burrito Day." It's a way to picture how your home, which is, you know, a very important part of your life, could actually help bring about some of that easygoing joy you might be looking for. Many people, it turns out, have been finding themselves in a situation where the usual ways of getting money from their homes just haven't worked out for them, and that's actually a pretty common story.

For a long time, the traditional paths for homeowners to get some financial breathing room, especially using what they've built up in their homes, have sort of left some folks on the sidelines. It's almost as if the system was not quite set up for everyone, leaving many good people without options when they needed them most. This means that if you're an everyday American homeowner, you might have felt like you were missing out on opportunities that others seemed to have, and that's a feeling nobody wants to have, is that right?

But there's a different way to think about things, a path that helps those who've felt a little overlooked by the usual banks and financial institutions. It's about seeing your home not just as a place you live, but also as a source of potential ease and comfort, a way to, perhaps, fund a little bit of that "burrito day" kind of freedom. There are, of course, many different ways people try to get money from their homes, but some options are just a little bit more straightforward and less stressful, you know?

Table of Contents

- What Does Feeling Free on Unlock Burrito Day Mean for Your Home?

- How Does Unlock Help Everyday Homeowners Celebrate Unlock Burrito Day?

- Is Your Home Ready for Its Own Unlock Burrito Day?

- Understanding the Unlock Burrito Day Agreement

- The Journey to Your Own Unlock Burrito Day

- Why Your Privacy Matters on Unlock Burrito Day

- No Loan Worries for Your Unlock Burrito Day

- Getting Ready for Your Best Unlock Burrito Day

What Does Feeling Free on Unlock Burrito Day Mean for Your Home?

You know, for so many people, their home is more than just walls and a roof; it's a place where memories are made, where life happens, and it's also a pretty significant financial asset. Yet, for a lot of everyday American homeowners, getting to the money that's tied up in their home, what we call home equity, can feel like trying to solve a very complicated puzzle. The regular financial ways of doing things, like getting a second mortgage or a home equity line of credit, sometimes just don't quite fit everyone's situation, and that's okay, actually.

It's almost as if some people have been, in a way, left behind by the traditional home and finance system. They might have a lot of value in their home, but for one reason or another, the usual doors to access that value seem to be closed off to them. This could be because of income requirements, credit scores, or just the general rules that the big banks often have. So, the idea of having a "burrito day" where you just feel easy and relaxed, well, that kind of feeling seems pretty far off when you're dealing with all that, you know?

But what if there was a different approach, one that was built with those everyday homeowners in mind? A way to access the money in your home without having to jump through all the hoops that often come with traditional loans. This is where the concept of an Unlock home equity agreement really comes into its own. It's a different kind of tool, one that aims to provide a more direct and less complicated path to using the value you've built up in your home, allowing you to finally feel a bit more financially comfortable, sort of like a calm, happy "unlock burrito day" kind of feeling.

How Does Unlock Help Everyday Homeowners Celebrate Unlock Burrito Day?

So, you might be wondering, how exactly does Unlock manage to help people who've felt a little bit stuck? Well, it starts with recognizing that not everyone fits into the same financial box, and that's perfectly fine. The company's whole purpose is to offer a different kind of financial solution for people who own their homes but might not have found success with banks or other lenders. It's about providing a path that's more inclusive, and in some respects, more understanding of real-life situations.

While there are many different ways people try to get money from their home's value, like getting a loan or a line of credit, Unlock offers something called a home equity agreement. This is a pretty distinct way of doing things. It's not a loan, which is a very important point, and it's designed to give homeowners a way to get cash from their property without taking on new debt or having to make monthly payments. This approach can feel like a breath of fresh air for many, almost like finding a shortcut to that easy "unlock burrito day" feeling.

The goal here is to give homeowners more options, especially those who have worked hard to build up value in their homes but haven't been able to use it when they needed it. Whether you're looking to pay off some bills, fix up your place, or just have a bit more financial freedom, an Unlock home equity agreement could be a good fit. It's about putting the power back in your hands, allowing your home to work for you in a way that feels right and helps you get to that celebratory "unlock burrito day" moment.

Is Your Home Ready for Its Own Unlock Burrito Day?

A question that often comes up is whether a homeowner's situation fits with what Unlock offers. You might be wondering, for example, if this kind of arrangement is something that could work for you, especially if you own rental properties or other kinds of investment properties. It's a good thing to think about, because your financial plans and what you want to achieve are very personal, you know?

Unlock's approach is generally aimed at helping a wide range of homeowners. If you have equity built up in your home, whether it's your main residence or perhaps a property you use for investment, there's a good chance that an Unlock home equity agreement could be an option for you. The idea is to provide a flexible way to get access to the money you've built up, no matter what your specific property ownership looks like. This flexibility is what helps make that "unlock burrito day" feeling a possibility for more people.

So, if you're someone who has been thinking about how to best use the value in your home, perhaps to make other investments, or maybe just to have some cash on hand for life's unexpected moments, it's worth exploring. The process is designed to be straightforward, helping you see if your home is a good fit for this kind of arrangement. It's about finding solutions that genuinely help you move forward, giving you that sense of control and ease, kind of like planning for a delightful "unlock burrito day."

Understanding the Unlock Burrito Day Agreement

When we talk about getting money from your home, it's pretty common for people to immediately think of loans. But the way Unlock works is quite different, and it's important to really get a good grasp of what a home equity agreement is all about. This isn't a loan, and that's a very key distinction that sets it apart from many other financial products out there, which, in some respects, makes it quite unique.

With a traditional loan, you borrow a certain amount of money, and then you have to pay it back over time, usually with interest, and you have those regular monthly payments. That's just how loans work, more or less. But with the cash you get from Unlock, it's not a loan, so you don't pay any interest on it. And, perhaps even better for many people, you don't have to make any monthly payments. This can be a huge relief for homeowners who are looking for financial flexibility without adding another bill to their list, allowing them to truly savor their "unlock burrito day" without financial stress.

This means that the money you receive is yours to use without the immediate pressure of repayments. The way it works is that Unlock shares in the future value of your home, which is a different model entirely. It's a partnership, in a way, rather than a debt. This kind of arrangement can provide a sense of freedom that traditional loans simply cannot, giving you the ability to use your home's value without the usual burdens. It’s a bit like getting a gift that keeps on giving, making every day feel a little more like "unlock burrito day."

The Journey to Your Own Unlock Burrito Day

So, if the idea of getting cash from your home without a loan sounds appealing, you're probably wondering what the steps are to actually make it happen. Unlock has a process that aims to be as clear and as simple as possible, because nobody wants to deal with a lot of confusing paperwork or unclear instructions when they're trying to get things done, do they?

The first step often involves just learning a little bit more about what a home equity agreement means for you. Unlock is pretty open about telling you everything you need to know to apply. This includes understanding how the agreement works, what information you'll need to provide, and what the overall timeline might look like. It's about making sure you feel comfortable and informed every step of the way, which is, you know, very important for something as significant as your home.

Once you're ready, you can securely log in to Unlock's platform. This is where you can manage your home equity release application and get access to services that are made just for you. The platform is set up to guide you through the process, making it as smooth as it can be. It’s all about making sure you have a good experience as you move towards that financial flexibility that could make every day feel a bit more like "unlock burrito day."

Why Your Privacy Matters on Unlock Burrito Day

When you're dealing with something as personal as your home and your finances, it's only natural to be concerned about your personal information. You want to know that the people you're working with are taking good care of your data, and that's a very fair expectation, isn't it?

Unlock makes it very clear that your privacy is a top concern for them. From the moment you welcome yourself to Unlock's home equity release application, they want you to feel secure. They respect your privacy and your right to control how they collect, use, and share your personal data. This means they are committed to being transparent about their practices and ensuring that your sensitive information is handled with the utmost care, which is, you know, really what you'd hope for from any financial service.

Knowing that your personal details are being protected can give you a lot of peace of mind as you go through the application process. It allows you to focus on the possibilities that an Unlock home equity agreement can open up for you, rather than worrying about who has access to your information. This commitment to keeping your data safe is just another way Unlock aims to make the whole experience as stress-free as possible, letting you look forward to that peaceful "unlock burrito day" feeling.

No Loan Worries for Your Unlock Burrito Day

One of the most appealing aspects of an Unlock home equity agreement, and something that truly sets it apart, is that the cash you receive is not a loan. This is a pretty big deal for many homeowners, especially those who might already have a lot of debt or are trying to avoid taking on more, which is, you know, a very common goal for people looking for financial breathing room.

Because it's not a loan, there are some really significant benefits. For starters, you pay no interest on the money you get. Think about that for a moment: no ongoing interest charges that can add up over time and make the total cost much higher. This can mean a lot more of your home's value stays in your pocket, where it belongs. It's a very different way of thinking about accessing your home's wealth, and it can be quite liberating, almost like a financial fresh start for your "unlock burrito day."

Furthermore, and this is another huge point for many people, you make no monthly payments. That's right, no new bill to add to your monthly budget. This can free up your cash flow and reduce financial pressure, allowing you to use the money for what you need without the immediate burden of regular repayments. This unique structure is designed to give you true financial flexibility, helping you achieve your goals without the typical loan obligations, making your "unlock burrito day" truly worry-free.

Getting Ready for Your Best Unlock Burrito Day

So, with all this talk about a different way to access your home's value, you might be feeling a bit more curious about what's next. The core question for many homeowners often comes down to this: are you ready to tap your home equity without a loan? It's a question that invites you to think about your financial future in a new light, and, you know, that's a pretty exciting thing to consider.

Unlock is here to guide you through everything you need to know to apply for a home equity agreement. They want to make sure you have all the facts, so you can make a decision that feels right for you and your family. It's about providing clear information and support, so you can move forward with confidence, knowing that you're exploring an option that could truly help you achieve your financial aims.

The possibility of using the value you've built up in your home, without the traditional loan structure, can open up a lot of doors. Whether it's for home improvements, managing other expenses, or just having a financial cushion, an Unlock home equity agreement offers a path to financial ease. It's about empowering you to use your home's value on your own terms, helping you get to that feeling of comfort and celebration, a bit like having your very own "unlock burrito day" whenever you need it.

This article has explored how Unlock aims to assist everyday American homeowners who may have felt overlooked by traditional financial systems. We've looked at how a home equity agreement differs from a loan, emphasizing the absence of interest and monthly payments. We also covered the secure platform for applications, the commitment to privacy, and the general process for understanding and applying for this unique financial solution, all with the aim of helping you achieve a sense of financial freedom and ease.

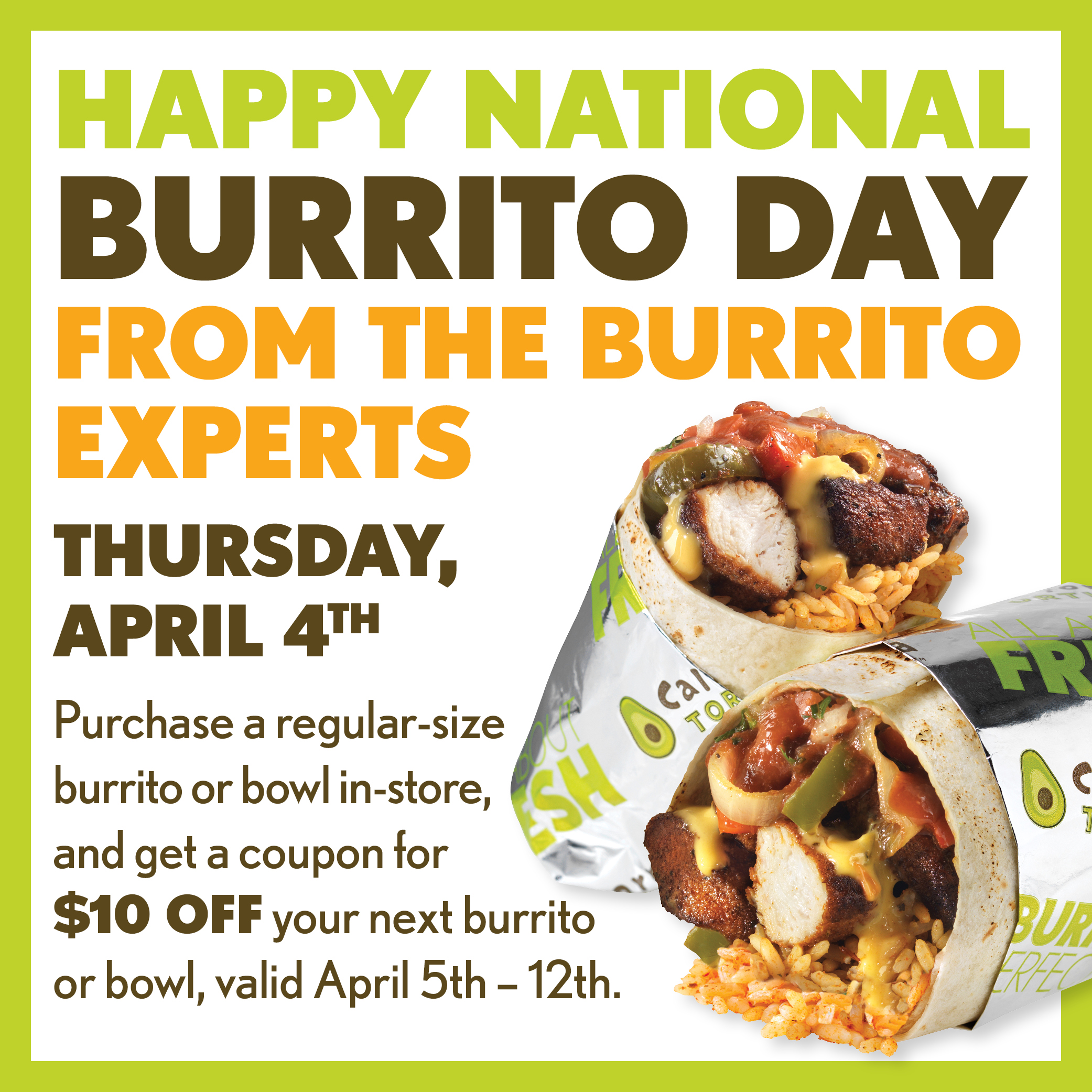

National Burrito Day - California Tortilla

National Burrito Day - Parkville Market

Chiptole Burrito Vault game Unlock Burrito Day: How to win free burritos