Mark Carney Net Worth - A Look At His Financial Journey

Many folks often wonder about the financial standing of public figures, especially those who've held some of the most significant roles in global finance, and Mark Carney is certainly one such individual whose career has spanned across very influential positions. People naturally get curious about what someone like him might have accumulated over a lifetime of such demanding work. It’s a common thing to think about, really, when you consider the kind of responsibilities he's carried.

When we talk about "mark carney net worth," it's not just about a simple number; it's a reflection, in some ways, of a remarkable career that has touched various corners of the financial world. From central banking to climate finance, his professional path has been quite unique, and, you know, it's pretty interesting to think about how someone's professional life shapes their personal wealth. We're going to take a closer look at what might contribute to such a figure, considering his different roles and what they typically entail.

So, figuring out an exact figure for someone's personal finances, particularly for a person like Mark Carney, can be a bit tricky, as these details are often kept private. What we can do, though, is piece together a picture based on publicly available information about his various roles and the kinds of compensation those positions usually carry. This way, we can get a general sense of the financial story behind a name that's become quite prominent in global economic discussions, as a matter of fact.

Table of Contents

- Mark Carney - A Glimpse into His Life

- What Roles Has Mark Carney Held?

- How Did Mark Carney's Career Shape His Finances?

- Mark Carney's Public Service and Its Pay

- Beyond Central Banking - Other Financial Activities

- What About His Post-Public Service Earnings?

- Estimating Mark Carney Net Worth - A General Idea

Mark Carney - A Glimpse into His Life

Mark Carney is someone whose name has come up quite a bit in conversations about global money matters and how economies work. He's a person who has held some very weighty jobs, shaping financial systems in more than one country. His background is a mix of academic learning and practical experience at the highest levels of finance, which, you know, is quite a combination. He’s often seen as a steady hand, someone who understands the ins and outs of financial stability, and that sort of reputation is built over many years of serious work, actually.

Before taking on the big roles that made him a public figure, he spent time in the private sector, which gave him a good grasp of how markets operate from a different angle. This early experience, a bit like a foundational period, prepared him for the intense pressures of public service. It’s fair to say his career path has been anything but ordinary, moving from private banking to leading national financial institutions, so it’s pretty clear he’s had a varied professional life.

Personal Details and Bio Data

To give you a clearer picture of the person we're talking about, here are some basic details about Mark Carney. These bits of information help paint a portrait of his background and where he comes from, which, in some respects, can influence one's professional journey and, by extension, their financial story. It's just a little bit of context to get us started, you know.

| Detail Category | Information |

|---|---|

| Full Name | Mark Joseph Carney |

| Date of Birth | March 16, 1965 |

| Place of Birth | Fort Smith, Northwest Territories, Canada |

| Nationality | Canadian, British, Irish |

| Education | Harvard University (BA), Oxford University (MPhil, DPhil) |

| Spouse | Diana Fox Carney |

| Children | Four daughters |

| Notable Roles | Governor of the Bank of Canada, Governor of the Bank of England, UN Special Envoy for Climate Action and Finance |

As you can see, his educational background is pretty strong, with degrees from well-known universities. This kind of academic grounding often sets the stage for a career in high-level economic policy, which, as a matter of fact, is exactly what happened for him. His diverse nationalities also speak to a broad perspective, perhaps helping him adapt to different financial environments during his career, so that's something interesting to consider.

What Roles Has Mark Carney Held?

Mark Carney's professional life has been marked by a series of very important positions, each carrying significant responsibility for financial stability and economic policy. He started out in the world of private investment banking, working for Goldman Sachs for a good number of years. This period gave him a direct look at how global markets operate and, naturally, how big financial deals are put together. It’s pretty much where he honed many of his early financial skills, you know.

After his time in the private sector, he moved into public service, first taking on a senior position at the Canadian Department of Finance. This was a pretty big shift, going from making money for a firm to helping shape the financial policies of a whole country. Then came his time as the Governor of the Bank of Canada, a role that put him in charge of his home country's monetary policy. This was a period where he gained a lot of public recognition, especially during the global financial difficulties, as a matter of fact.

Perhaps his most widely known role was as the Governor of the Bank of England. He was the first non-Briton to hold this very old and respected position, which says a lot about his reputation and perceived abilities. In this job, he was a key figure in guiding the UK economy through some very uncertain times, including the period after the Brexit vote. He had a lot on his plate there, trying to keep things steady, and it was a job with immense public scrutiny, too it's almost.

More recently, he's taken on a role focused on climate change and finance as the UN Special Envoy for Climate Action and Finance, and also as the chair of Brookfield Asset Management's transition fund. These roles show a shift in his focus towards sustainability and green finance, which, you know, is a really big topic these days. Each of these jobs, in their own way, would have come with a certain level of compensation, contributing to his overall financial picture, obviously.

How Did Mark Carney's Career Shape His Finances?

The progression of Mark Carney's career, from investment banking to leading central banks and then moving into climate finance, has definitely had a significant impact on his personal finances. His early years at Goldman Sachs, for instance, would have likely provided him with a very solid financial foundation. Investment banking, especially at a firm like Goldman, is known for offering some rather generous pay packages, including salaries, bonuses, and sometimes stock options, which can add up to a lot, you know.

When he transitioned to public service, the pay structure changed quite a bit. While central bank governors earn a good living, it's generally not on the same scale as top private sector executives. However, these public roles come with other benefits, like pension contributions and a high degree of job security, which are valuable in their own way. The prestige and influence gained from these positions can also open doors to lucrative opportunities later on, as a matter of fact.

For example, as Governor of the Bank of Canada, his salary would have been set by the Canadian government, and similar arrangements were in place during his time at the Bank of England. These are public salaries, so the figures are generally available for anyone to look up. They are designed to attract very capable people to these important jobs, but they are still within the bounds of public sector compensation, which is usually more modest than what you'd find in the highest echelons of private finance, pretty much.

His more recent work in the private sector with Brookfield Asset Management, a large global alternative asset manager, likely comes with a different kind of pay structure, perhaps including performance-based incentives and equity stakes. This kind of role has the potential to add significantly to his wealth, given the scale of operations in that sector. So, his financial situation is a blend of earnings from various types of work over many years, each contributing in its own unique way, you know, to be honest.

Mark Carney's Public Service and Its Pay

When someone takes on a job in public service, especially at the level of a central bank governor, their compensation is typically a matter of public record. These roles are incredibly important for a country's economic health, so the pay needs to be enough to attract top talent, but it's also paid for by the public, so it's not usually extravagant. For Mark Carney, his time as Governor of the Bank of Canada and then the Bank of England meant his salary was set by the respective governments, and these figures were published, obviously.

For instance, during his tenure as Governor of the Bank of England, his salary was in the hundreds of thousands of pounds each year. This figure, while substantial, is still a fraction of what someone with his experience and capabilities could earn in a top role in a private financial institution. The compensation for such a position usually includes a base salary, and sometimes a pension contribution, but generally no large performance bonuses like those seen in investment banking, as a matter of fact.

The idea behind these public service salaries is to ensure independence and integrity. You want someone leading the central bank to be focused on the national interest, not on personal profit from market dealings. So, the pay is good enough to live a very comfortable life, but it's not designed to make someone extremely wealthy overnight. It’s a different kind of motivation, really, when you're serving the public, and that's something that often gets overlooked, you know.

His time in these roles also came with certain perks, like official residences or allowances for living expenses, which are common for high-ranking public officials. These aren't direct cash payments, but they do reduce personal outgoings, which, in a way, adds to one's overall financial well-being. So, while the headline salary might seem high, it's important to see it in the context of public sector pay scales and the huge responsibilities involved, pretty much.

Is Mark Carney's Wealth Tied to His Public Profile?

It's an interesting question whether someone's public profile, especially one as prominent as Mark Carney's, directly affects their personal wealth. In a way, it absolutely does, but perhaps not in the most obvious sense. His public standing, built on years of high-level service and perceived competence, has certainly opened doors to opportunities that might not be available to others. This isn't about direct payments for being famous, but rather about the value placed on his experience and insights, you know.

For example, after leaving the Bank of England, he took on roles that leverage his deep knowledge of global finance and his credibility on issues like climate change. These positions, such as his work with the UN and Brookfield, are very significant and likely come with substantial compensation. His public profile makes him a sought-after advisor and leader in these fields, meaning his expertise is highly valued, and that translates into earning potential, as a matter of fact.

Think about it: a person with his kind of background can command higher fees for speaking engagements, advisory roles, or board positions. Companies and organizations want the insight and the reputation that someone like him brings. So, while his public service roles themselves didn't make him a billionaire, the reputation and connections built during those times have certainly created a very strong foundation for his post-public service financial activities, basically.

So, yes, his wealth is tied to his public profile, but it’s more about how that profile enhances his marketability and the demand for his specific skills and experience. It's not about being a celebrity in the traditional sense, but about being recognized as an authority in global economics and finance. That recognition, quite naturally, carries a significant economic value in the professional world, and that's something we often see with figures who have served at such high levels, you know.

Beyond Central Banking - Other Financial Activities

While Mark Carney is most widely recognized for his time leading central banks, his financial activities extend beyond those public service roles. Before and after his time at the Bank of Canada and the Bank of England, he engaged in other types of work that would contribute to his overall financial picture. His early career at Goldman Sachs, as we touched on, was a significant period where he gained experience in investment banking, and that sort of work typically comes with very competitive pay, as a matter of fact.

After stepping down from the Bank of England, he didn't retire from the financial world. Instead, he moved into new areas, particularly focusing on the intersection of finance and climate action. His role as the UN Special Envoy for Climate Action and Finance is a high-profile advisory position that, while perhaps not directly a source of immense personal wealth, positions him at the forefront of a rapidly growing and very important sector. This kind of work helps shape future financial trends, you know.

He also joined Brookfield Asset Management as Vice Chair and Head of ESG (Environmental, Social, and Governance) and Impact Fund Investing. This is a significant private sector role with a major global firm. Positions like this in large asset management companies often come with a combination of a good base salary, performance-related bonuses, and potentially equity participation. This means his earnings here could be quite substantial, depending on the success of the funds he helps manage, pretty much.

These post-central bank roles show a strategic move into areas where his expertise and influence are highly valued. They allow him to continue contributing to global financial discussions, but now from a different vantage point, one that offers a different kind of financial reward. So, his financial journey isn't just about public service salaries; it also includes periods of earning from the private financial world, both early in his career and more recently, which is something important to consider, naturally.

What About His Post-Public Service Earnings?

After a distinguished career in public service, especially at the very top levels, individuals like Mark Carney often find themselves in high demand in the private sector or in international organizations. This is because their experience, their network of contacts, and their deep understanding of global economics are incredibly valuable. So, his post-public service earnings are likely a very important part of his overall financial picture, arguably even more so than his public salaries, you know.

His move to Brookfield Asset Management is a prime example of this. Brookfield is a massive player in the alternative asset space, managing vast sums of money across various sectors. Being a Vice Chair and leading significant investment initiatives there means he's involved in high-stakes financial operations. The compensation for such roles in large private equity or asset management firms can be very generous, often including a share of the profits or performance fees, which can accumulate quite quickly, as a matter of fact.

Beyond his formal roles, it's common for former central bank governors to be sought after for speaking engagements, advisory board positions, or as consultants for various companies and institutions. Each of these opportunities would come with its own fee, adding to his income. His insights on global economic trends, financial stability, and climate finance are highly valued, making him a compelling speaker for conferences and private events, and that's a source of income that can be pretty significant, too it's almost.

These post-public service activities represent a shift in how his wealth might grow. While public service pay is steady and respectable, the private sector offers the potential for much larger earnings, especially for someone with his unique background and reputation. So, when thinking about "mark carney net worth," it's really important to consider this later phase of his career, as it likely contributes a very substantial portion to his total financial standing, basically.

Estimating Mark Carney Net Worth - A General Idea

Putting an exact figure on "mark carney net worth" is, to be honest, a very difficult task because personal financial details are private. However, we can make some educated guesses based on the typical compensation for the kinds of roles he has held throughout his very impressive career. It's about piecing together a mosaic of public information and general industry knowledge to get a rough idea, you know.

His time at Goldman Sachs would have provided a strong financial base, likely including bonuses and perhaps equity that would have grown over time. Then, his years as a central bank governor, first in Canada and then in the UK, came with substantial, though publicly disclosed, salaries. These positions, while not making one a billionaire, certainly provide a very comfortable living and allow for significant savings and investments, as a matter of fact.

The most recent phase of his career, particularly his involvement with Brookfield Asset Management, likely represents the period with the highest potential for significant wealth accumulation. In the world of private asset management, top executives can earn millions, sometimes tens of millions, through salaries, bonuses, and participation in fund performance. This kind of compensation structure is very different from public service pay, and it can add up very quickly, pretty much.

When you consider all these factors—early private sector earnings, years of high-level public service salaries and pensions, and then a return to the high-earning private financial sector—it's reasonable to assume that Mark Carney's net worth is in the millions, quite possibly in the double-digit millions. This is a general estimate, of course, as we don't have access to his personal financial statements, but it gives a sense of the scale of his financial success, which is a reflection of his long

Mark Zuckerberg Facts | Britannica

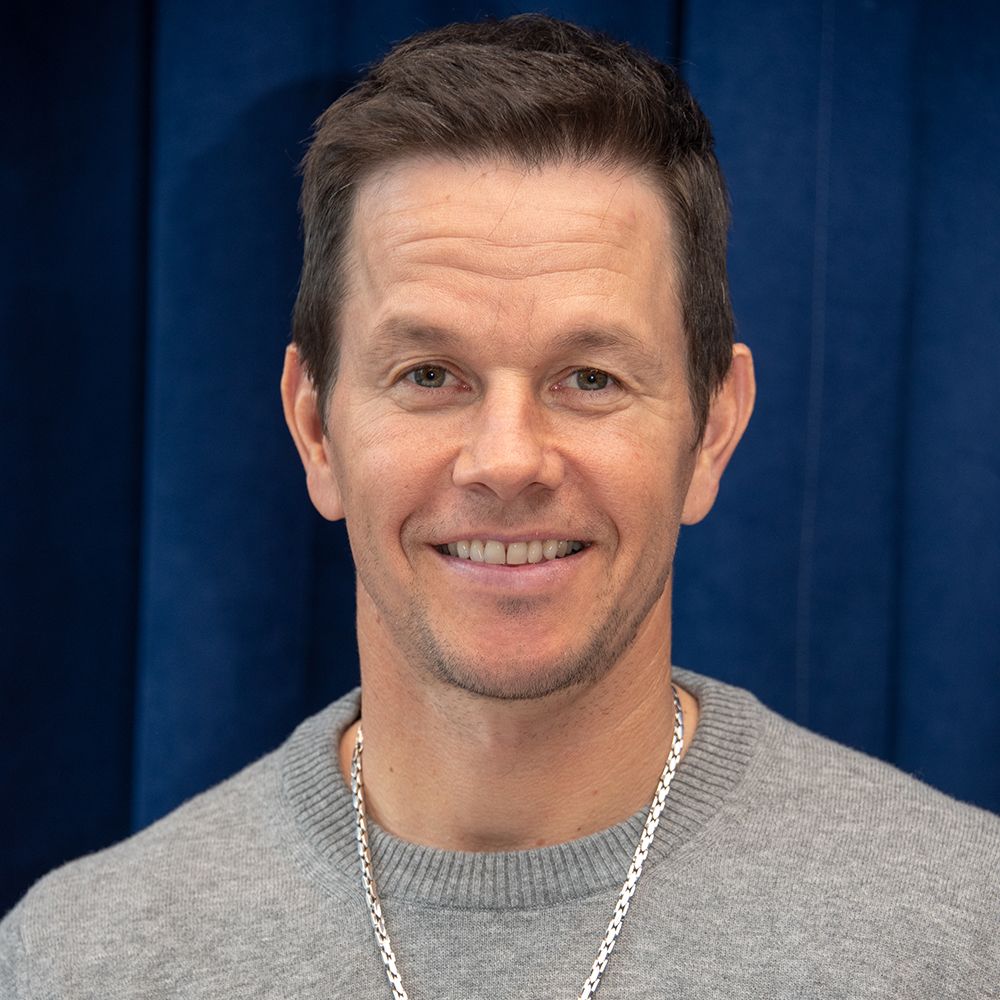

Mark Wahlberg

Mark Zuckerberg Shows Off Lean Physique During Mixed Martial Arts