Top 10 Percent Net Worth By Age - What It Means

Thinking about where you stand financially can bring up a lot of questions. We often hear about people with significant wealth, and it is natural to wonder what that truly looks like for folks at different points in their lives. This idea of the "top 10 percent" in terms of money saved and owned often sparks curiosity, making us consider what it takes to get there or even just how it compares to our own financial picture. You might, for example, find yourself curious about the money habits of others.

It is, as a matter of fact, more than just a number; it represents a certain level of financial comfort and opportunity. For many, it is a goal, a marker of success, or simply a way to measure progress on their money journey. Knowing what these figures look like can offer a clearer picture of what a substantial financial standing means at various stages of life, from early working years to retirement.

This discussion will, you know, look at what it means to be in that financially stronger group, breaking it down by how old someone is. We will talk about how these figures are usually put together and why your age plays such a big part in how much money you might have put aside. We will also, like, explore some general ideas about how people build their wealth over time, offering some thoughts on what you might expect or aim for.

Table of Contents

- What Does "Top 10 Percent Net Worth" Really Mean?

- How Do We Figure Out Top 10 Percent Net Worth by Age?

- Why Does Age Play a Role in Financial Accumulation?

- What Might Top 10 Percent Net Worth by Age Look Like for You?

- Are There Common Ways to Achieve Top 10 Percent Net Worth by Age?

- Considering Different Life Stages and Wealth

- Youthful Beginnings and Building Net Worth

- Later Years and Sustaining a Strong Financial Standing

What Does "Top 10 Percent Net Worth" Really Mean?

When we talk about someone's net worth, we are simply looking at everything they own that has value, like money in the bank, investments, real estate, and even cars, and then subtracting everything they owe, such as mortgages, loans, or credit card balances. The number that is left over is their net worth. So, if your assets are more than your debts, you have a positive net worth. If your debts are more than your assets, then your net worth is negative. This is, you know, the basic idea behind it.

Being in the "top 10 percent" means your net worth places you among the wealthiest tenth of all households in a given population. This group holds a significant portion of the total wealth in a country. It is, in fact, a benchmark that helps us understand wealth distribution. These figures often come from surveys that gather information on people's finances.

It is pretty common for people to wonder about these numbers, especially since they can change quite a bit depending on where you live or what year it is. The actual dollar amounts for the top 10 percent net worth can vary a lot, you know, from one report to another, but the idea behind it stays the same: it is about having a higher amount of assets compared to debts than most other people.

How Do We Figure Out Top 10 Percent Net Worth by Age?

To get these figures, researchers usually look at large sets of financial information from many different households. They collect data on what people own and what they owe. Then, they sort all of this information by age groups. For example, they might look at people in their 30s, then people in their 40s, and so on. This helps them, you know, see how wealth tends to grow or change over a person's lifetime.

After sorting by age, they then rank everyone within each age group from the lowest net worth to the highest. The "top 10 percent" for a specific age group would be the net worth amount at which only 10 percent of the people in that group have more money. This gives us a clear picture of the financial standing for the upper tier of each age bracket. It is, you know, a way to put things in perspective.

It is important to remember that these numbers are averages or medians from a large group of people. Your own situation might be different, as a matter of fact. They do not account for every single person's unique financial story, but they offer a general idea of what a strong financial position looks like for the top 10 percent net worth by age.

Why Does Age Play a Role in Financial Accumulation?

Age has a very significant part in how much money someone has put aside. When people are younger, they are often just starting their careers, paying off student loans, or perhaps saving up for a first home. They might not have had as much time to earn and save money, or for their investments to grow. So, their net worth figures usually start out smaller, which is, you know, pretty natural.

As people get older, they typically have more years of working under their belt. This means more income earned and, with good money habits, more opportunities to save and invest. Over time, these savings can grow through the magic of compounding, where your money starts earning money on itself. This effect, you know, really starts to show its impact as the years go by.

Also, older individuals may have paid off significant debts, like mortgages, which greatly increases their net worth. They might also have retirement accounts that have been building up for decades. So, it is pretty clear that time, in a way, is a huge factor in building up a substantial amount of wealth, making the top 10 percent net worth by age figures look quite different across various age groups.

What Might Top 10 Percent Net Worth by Age Look Like for You?

While specific numbers can vary, we can talk generally about what kind of financial standing this might represent. For younger individuals, say in their 20s or early 30s, reaching the top 10 percent net worth by age might mean having little to no debt, a good emergency fund, and perhaps some early investments in retirement accounts. It is, you know, about building a strong foundation.

For people in their 40s or 50s, the top 10 percent net worth by age would likely include a paid-off or nearly paid-off home, substantial retirement savings, and perhaps other investment accounts. They have had more time for their assets to grow and have likely been earning more for a longer period. This is, you know, where the effects of consistent saving really start to show.

By the time people reach their 60s and beyond, the top 10 percent net worth by age often involves significant retirement funds, possibly multiple properties, and a general sense of financial security that allows for a comfortable lifestyle without needing to work. It is, pretty much, the result of many years of careful financial planning and consistent effort.

Are There Common Ways to Achieve Top 10 Percent Net Worth by Age?

While everyone's path is different, some common habits and approaches tend to help people reach a higher financial standing. One very important thing is consistent saving. Putting money aside regularly, even small amounts at first, can add up over time. This is, you know, a simple but powerful idea.

Another common strategy is making smart choices with investments. This does not mean needing to be a stock market expert, but rather understanding how to put your money to work so it grows. Often, this involves investing in things that grow over the long term, like broad market index funds or real estate. It is, for example, about letting your money do some of the work for you.

Finally, managing debt wisely is also a big part of it. Avoiding unnecessary high-interest debt and paying off loans as quickly as possible helps keep more of your money working for you rather than going to interest payments. These habits, you know, really contribute to building up your top 10 percent net worth by age.

Considering Different Life Stages and Wealth

Thinking about wealth accumulation through the lens of different life stages can give us a clearer picture of how net worth changes over time. Each stage brings its own set of financial opportunities and challenges. For instance, early adulthood is often about getting started, while later years focus more on preserving and enjoying what you have built. It is, basically, a progression.

During our working lives, our income usually rises, and with that, the potential to save and invest more also grows. This means that the financial goals and the ways we approach saving might look quite different depending on whether we are just out of school or nearing retirement. It is, you know, a dynamic process.

Understanding these typical patterns can help you set realistic expectations for your own financial journey. It is not about comparing yourself to others in a negative way, but rather about seeing the general path many people follow when building wealth over their entire lives. This perspective, you know, can be quite helpful.

Youthful Beginnings and Building Net Worth

In the earlier years, perhaps your 20s and early 30s, building net worth often begins with establishing a steady income and getting a handle on any existing debts, like student loans. At this stage, having a positive net worth, or even just breaking even, can be a good sign. The goal is, you know, to start creating a financial foundation.

For many, this period involves learning about personal finance, setting up a budget, and perhaps making those first few contributions to a retirement account. It is less about having a huge amount of money and more about forming good habits that will pay off later. You are, basically, planting seeds for future growth.

Small steps taken consistently in these early years can have a surprisingly big impact down the road because of the time factor. Even small amounts saved and invested can grow significantly over several decades. So, it is really about getting started and staying consistent, you know, as early as you can.

Later Years and Sustaining a Strong Financial Standing

As people move into their later working years and then into retirement, the focus shifts from aggressive accumulation to preserving and managing the wealth that has been built. For those who have reached a high financial standing, the aim is often to ensure their money lasts throughout their retirement and perhaps even leaves something for future generations. This is, you know, a different kind of financial challenge.

At this stage, investments might become more conservative, and there is a greater emphasis on creating a steady income stream from savings and investments. It is about enjoying the fruits of earlier labor and making sure the money continues to work for them without taking on too much risk. This is, you know, a time for financial peace of mind.

Maintaining a strong financial position in later life often involves careful planning for healthcare costs, estate planning, and ensuring that assets are managed in a way that supports a desired lifestyle. It is, in a way, the culmination of a lifetime of financial decisions and efforts.

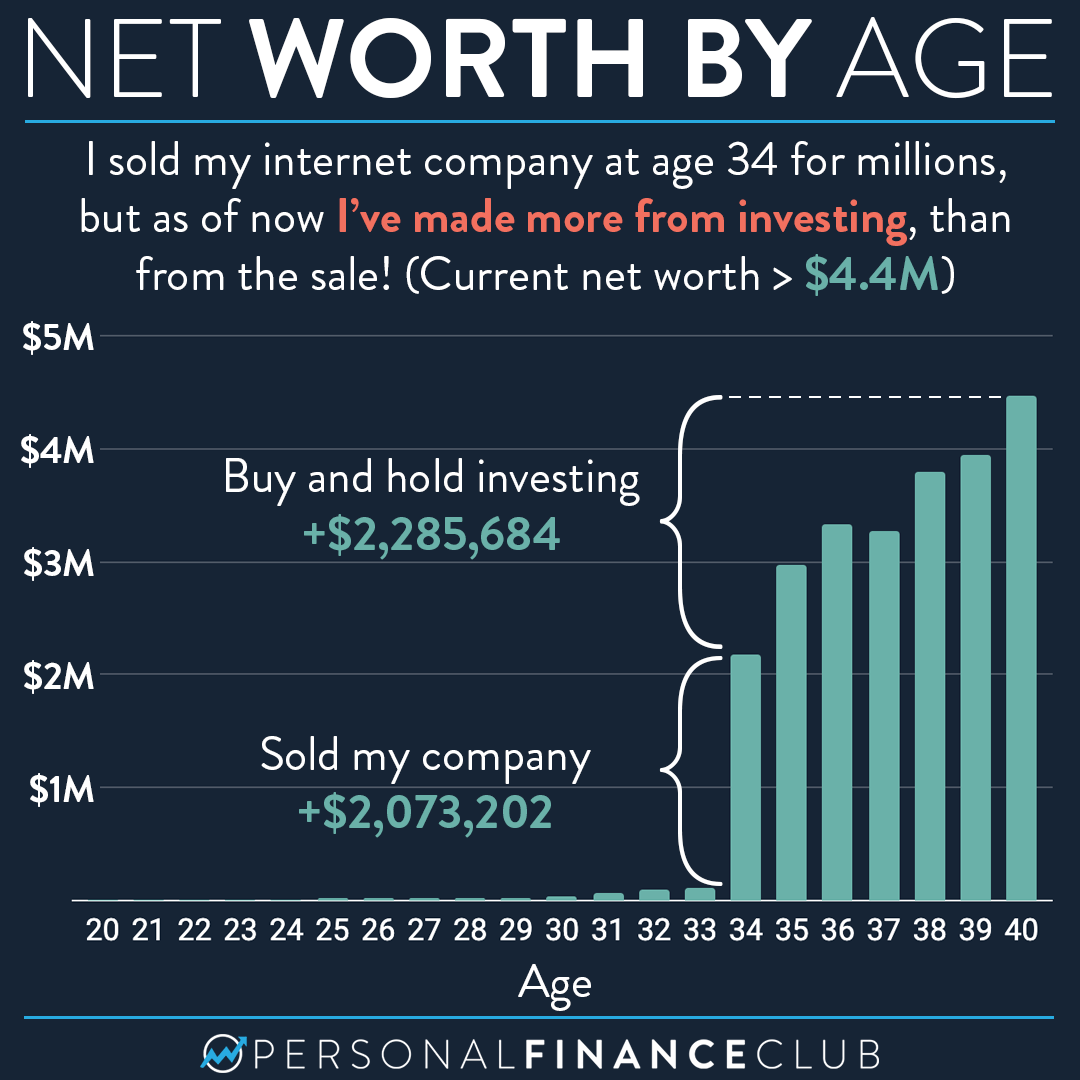

I’m a millionaire and this is my net worth by age – Personal Finance Club

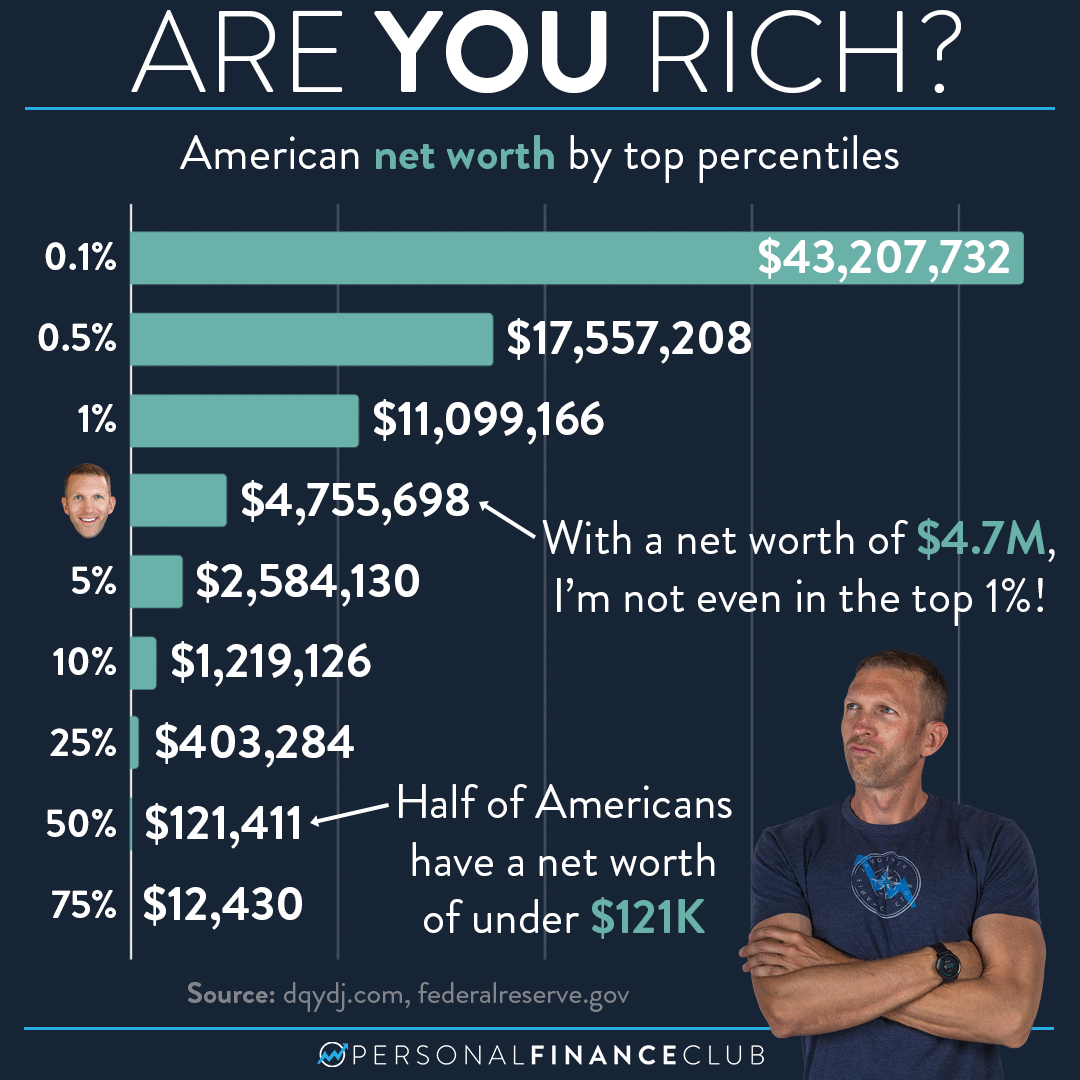

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

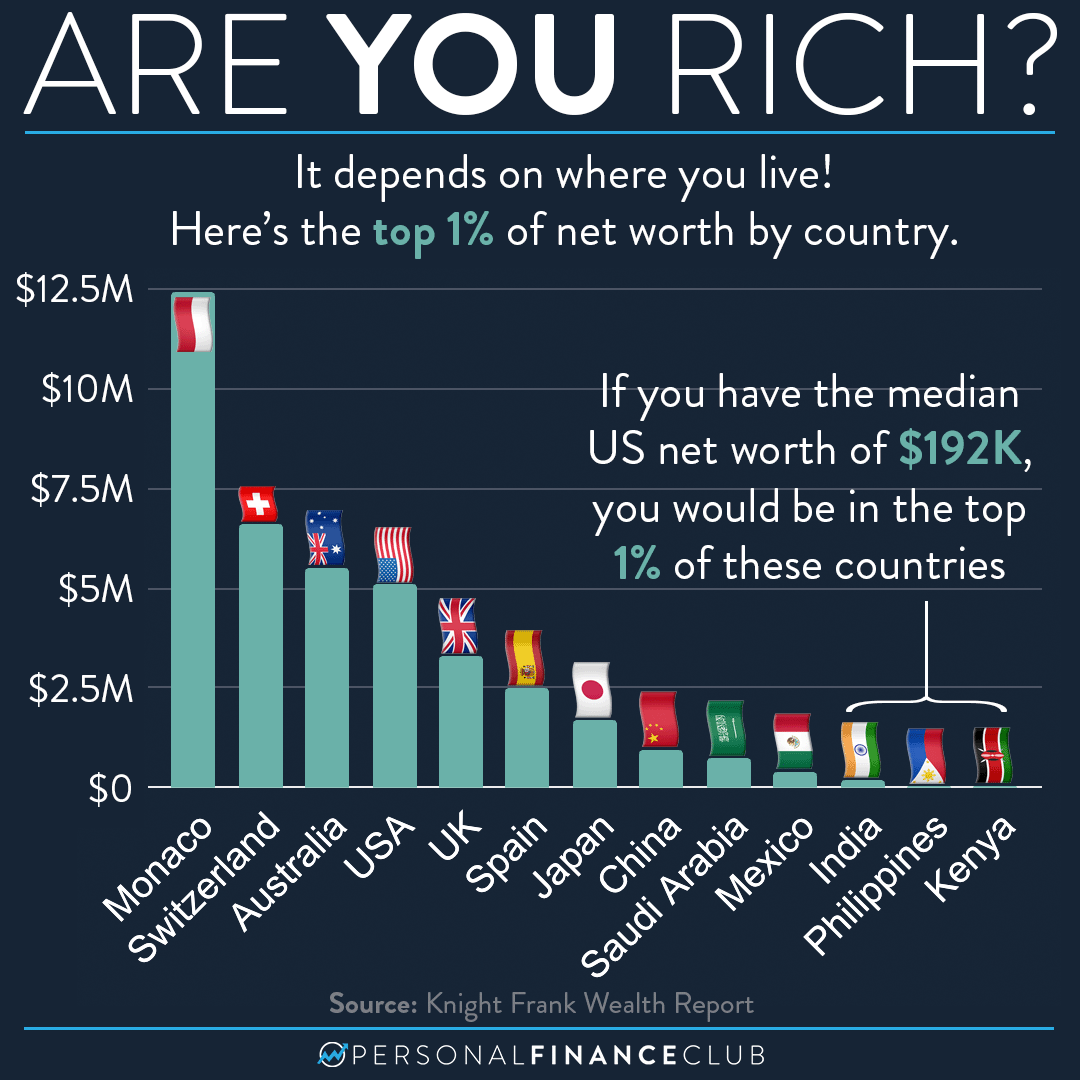

What is the top 1% of net worth by country? – Personal Finance Club