George Soros Net Worth - A Look At His Financial Journey

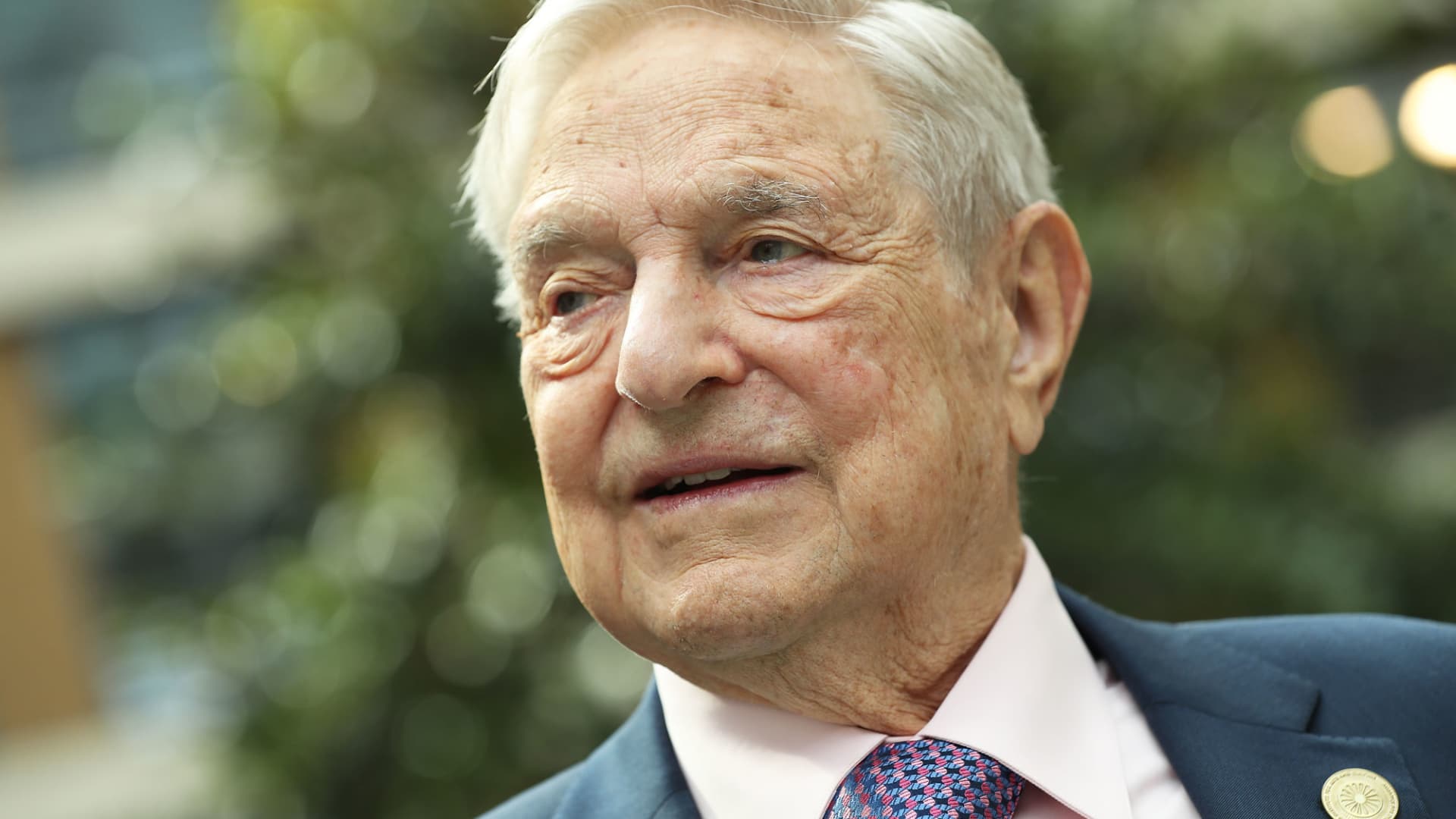

When we think about truly influential figures in the financial world, George Soros is a name that often comes up, someone whose impact stretches far beyond just his own personal wealth. He's a person who has, in a way, shaped economic discussions and even global events through his unique approach to money and his very public philanthropic endeavors. His story, you know, really gives us a lot to think about when it comes to how someone builds significant financial standing and what they choose to do with it.

His life, it seems, has been a series of rather bold moves and very calculated decisions, from his early days facing truly difficult circumstances to becoming a major player in international finance. It’s almost as if every step he took, every big financial bet, has contributed to the impressive figure that is his personal fortune. We'll be looking at some of the things that have been said about his financial journey, and how his ideas might just resonate with us.

This exploration will give us a glimpse into some of the elements that have contributed to his considerable financial standing, including his investment philosophy and his efforts to support various causes. It’s a chance, in some respects, to consider the different facets of a truly remarkable financial career and how it all ties back to the idea of "soros net worth."

Table of Contents

- Who is George Soros?

- What Shaped George Soros' Early Life and Wealth?

- The Financial Philosophy Behind Soros' Net Worth

- How Did George Soros Accumulate His Net Worth Through Bold Moves?

- Beyond the Markets - Soros' Net Worth and Philanthropy

- What Are Some Investment Strategies Related to Soros' Net Worth?

- Thinking About Retirement and Your Own Net Worth

- Can We Learn About Our Own Net Worth from Soros' Ideas?

Who is George Soros?

George Soros, a name quite widely recognized, was actually born György Schwartz in Budapest, Hungary, back in 1930. His early life, you know, had its own set of unique circumstances. His mother's family, as a matter of fact, had a successful silk shop, which suggests a background of some comfort and perhaps a certain kind of stability before things changed. His father, it seems, was also a part of this family story, though the details shared are a little less complete.

It’s quite interesting to consider how these early experiences, particularly the mention that his family, at some point, lost everything they had, might have shaped his outlook on the world and, indeed, his approach to managing money later on. A situation like that, where one's family loses it all, can really instill a deep sense of what it means to be financially secure, or perhaps, insecure. It could be that this very early life event played a significant part in forming the very astute financial mind he would later become known for.

Personal Details and Background

Here’s a quick look at some personal details about George Soros:

| Full Name | György Schwartz (Birth Name), George Soros (Later Name) |

| Born | 1930 |

| Place of Birth | Budapest, Hungary |

| Family Background | Mother's family owned a successful silk shop; family lost everything at one point. |

What Shaped George Soros' Early Life and Wealth?

The early years of George Soros’s life were, in some respects, quite formative, particularly given the historical period he was born into. The detail that his family lost everything they owned is a rather profound piece of information, suggesting a childhood that experienced significant upheaval. This kind of experience, you know, could very well instill a strong sense of caution, or perhaps, a deep drive to build and protect financial resources. It's almost as if such a beginning would compel someone to think differently about money and its preservation.

This early loss, one could argue, might have been a foundational element in shaping his future financial thinking and, by extension, his eventual "soros net worth." It’s not hard to imagine how someone who has seen their family's possessions vanish would develop a keen awareness of economic cycles and the importance of making shrewd decisions. This personal history, quite frankly, seems to be a quiet but powerful force behind the financial acumen he later displayed. The ability to recover from such a setback, and then to thrive, really speaks volumes about his character and resolve.

It’s interesting, too, to consider the contrast between his family's silk shop, a symbol of established business, and the later loss. This background, perhaps, gave him an early, practical exposure to commerce, even if it was eventually overshadowed by hardship. So, these early life experiences, while challenging, appear to have laid a very unique groundwork for the financial mind that would eventually become so well-known for its significant "soros net worth."

The Financial Philosophy Behind Soros' Net Worth

When you look at how people like George Soros, or even someone like Warren Buffett, managed to build their very considerable fortunes, there's a pretty common thread: they tend to do things differently. It takes, you know, a lot of inner strength, a kind of gutsy resolve, to 'zig' when pretty much everyone else is 'zagging.' This approach, as a matter of fact, is not about following the crowd; it's about having a completely independent view of the market and being willing to act on it, even when it feels counterintuitive.

This isn't just a casual observation; it's a fundamental aspect of how some of the most successful investors have managed to grow their "soros net worth" and others' financial holdings so dramatically. It means looking at situations and seeing possibilities that others might completely miss, or perhaps, are too afraid to consider. It's about being able to stand firm in your convictions when the popular opinion is going in a totally different direction. This sort of thinking, quite honestly, sets apart those who achieve truly exceptional financial results from those who just follow along.

The idea that investing is entertaining, or that you're having fun while doing it, is, according to some, a bit of a misconception. If you're really enjoying yourself too much, it's almost as if you're probably not making any money. This suggests that serious financial decisions, the kind that build a significant "soros net worth," are not necessarily about pleasure or excitement, but rather about a very disciplined and often solitary analytical process. It's about making tough calls and sometimes, quite frankly, going against your own emotional inclinations.

How Did George Soros Accumulate His Net Worth Through Bold Moves?

One of the most talked-about examples of George Soros's very bold investment moves, and a key contributor to his considerable "soros net worth," involved the British pound. There was a time when economic conditions in Great Britain were, to put it mildly, deteriorating. Eventually, this situation forced the Bank of England to devalue its currency, the pound. Soros, it turns out, had made a bet against the pound, a rather significant one, and when the devaluation happened, his position was proven absolutely correct. This particular event, you know, really cemented his reputation as a formidable and insightful financial player.

This kind of move, where you essentially bet against a major currency, takes a tremendous amount of conviction and, frankly, a willingness to take on enormous risk. It's a classic example of that 'zigging' when others are 'zagging' philosophy. He saw something that others either didn't see or weren't prepared to act upon, and that foresight, that courage to go against the prevailing sentiment, ultimately paid off in a very substantial way. It’s a clear illustration of how his particular brand of financial thinking directly impacted his "soros net worth."

It’s worth noting that this isn't just about a single lucky guess; it's about a consistent pattern of deep analysis and decisive action. Such moments, where an investor correctly predicts a major economic shift and positions themselves accordingly, are what contribute significantly to the growth of a fortune like the "soros net worth." It shows a mind that is constantly assessing, constantly looking for opportunities that arise from economic imbalances or shifts in policy, and then having the fortitude to act on those insights.

Beyond the Markets - Soros' Net Worth and Philanthropy

Beyond his well-known activities in the financial markets, George Soros also established the Open Society Institute. This organization, you know, supports a great many humanitarian projects. These efforts range pretty widely, from working to fight serious diseases and alleviate poverty, to actively encouraging and helping to grow democratic values around the world. It’s a clear demonstration that his interests extend far beyond just accumulating personal wealth.

The founding of such an institute, and its broad scope of work, really shows a commitment to using a portion of his "soros net worth" for what he perceives as the greater good. It’s not every day you see someone who has achieved such immense financial success dedicate so much of their resources and energy to causes that are, in some respects, quite distinct from the world of finance. This philanthropic side, quite frankly, adds another layer to understanding the individual behind the impressive financial figures.

These projects, fighting disease and poverty, and fostering democratic values, are rather significant global challenges. His involvement, through the Open Society Institute, means that a substantial amount of capital is directed towards these very important social issues. It suggests a belief that wealth, once acquired, carries with it a certain responsibility to contribute to societal improvement. This aspect of his work is, arguably, as much a part of his public identity as his financial dealings, and it certainly shapes how his "soros net worth" is perceived by many.

What Are Some Investment Strategies Related to Soros' Net Worth?

When we think about investment strategies, particularly those that have helped build a significant "soros net worth," it's interesting to look at the kinds of companies and approaches that have been mentioned. For example, some very prominent individuals have recently acquired shares of FedEx. Billionaires like George Soros himself, along with John Paulson and Dan Loeb, are all listed as shareholders. This suggests a certain confidence in the company's prospects from some of the biggest names in the investment community.

However, it’s also pointed out that these individuals, including Soros, don't necessarily hold the absolute largest stake in FedEx. This detail, you know, might hint at a strategy of diversification, or perhaps, taking positions that are meaningful but not necessarily controlling. It shows that even for investors with substantial resources, like those contributing to the "soros net worth," there’s a nuanced approach to how they allocate their capital across various companies and sectors. It’s not always about outright ownership but about strategic participation.

Furthermore, when we consider what makes a fund manager "best" to follow, people like George Soros (with his Quantum Fund), Carl Icahn (Icahn Capital), Bill Ackman (Pershing Square), and Ron Burkle (Yucaipa) are often mentioned. This implies that their particular methods, their ability to generate strong returns, and their overall financial acumen are seen as models for others. Studying their past moves, or even just understanding their general philosophies, can offer valuable insights into how a considerable "soros net worth" and similar fortunes are accumulated. It’s about learning from those who have demonstrated consistent success.

On a slightly different note, the text mentions that a "cleaner alternative for power plants over coal" remains a very important consideration. While not directly tied to Soros's personal investments here, this kind of statement could represent a broader awareness of environmental or technological shifts that might influence investment decisions. It’s possible that such considerations, like the move towards cleaner energy, could be factors that sophisticated investors like Soros might consider when evaluating long-term opportunities that could impact future "soros net worth" figures.

Thinking About Retirement and Your Own Net Worth

When we think about retirement, most people, you know, tend to picture a rather relaxing period. It's a time for spending quality moments with family, perhaps traveling to new places, and generally enjoying a break from the everyday demands of work. While there’s certainly no single right or wrong way to approach this stage of life, this common vision highlights a desire for comfort and financial peace of mind. It’s a period where one’s accumulated "net worth" truly comes into play, supporting the lifestyle one hopes to enjoy.

The concept of "George Soros' top 4 'retirement' stocks" is quite interesting in this context. While these might not be his personal retirement picks in the traditional sense, the very idea suggests that even for someone with an immense "soros net worth," there's a consideration for long-term, stable investments that could provide consistent returns. It speaks to the universal need for financial security, regardless of the size of one's fortune. The focus shifts from aggressive growth to preservation and steady income, which is a common goal for many people as they approach their later years.

This brings us to a more general point about personal finance: the belief that thrift is, quite frankly, essential to well-being. This idea, which is a fundamental principle for building any kind of lasting "net worth," suggests that careful management of resources, avoiding unnecessary spending, and saving diligently are crucial steps. It's a timeless piece of advice that applies whether you're starting out or already have a substantial amount of money. The discipline of thrift can really make a difference in how secure and comfortable your financial future feels.

Can We Learn About Our Own Net Worth from Soros' Ideas?

So, can we, in some respects, take lessons from someone like George Soros when we think about our own financial standing and building our personal "net worth"? It seems there are a few key takeaways. One of the most striking is that idea about having the courage to 'zig' when everyone else 'zags.' This isn't just about big, risky financial bets; it’s about thinking independently, doing your own research, and not simply following the latest trends or what everyone else is doing with their money. It’s about having a unique perspective.

Another point that really stands out is the philosophy that if investing feels like pure entertainment, if you're just having fun, you're probably not making any money. This suggests that serious financial growth, the kind that truly adds to your "net worth," requires a disciplined, often analytical, and sometimes even a somewhat detached approach. It’s less about excitement and more about careful consideration, which can be a bit of a sober thought for some. It means treating your financial decisions with a certain level of seriousness and focus.

And then there’s the emphasis on thrift, which is, honestly, a very simple but incredibly powerful concept. It’s about valuing what you have, being careful with your resources, and understanding that consistent saving and smart spending habits are the bedrock of any solid "net worth." It’s not necessarily about being stingy, but about being mindful and strategic with every dollar. So, while George Soros operates on a completely different scale, these core principles of independent thinking, serious financial discipline, and careful resource management are, you know, pretty universal for anyone looking to improve their financial situation.

Philanthropist George Soros donates most of his net worth to charity

George Soros Net Worth: Insights into His Wealth

George Soros Net Worth: Insights into His Wealth