Top 10 Percent Net Worth By Age - Your Financial Picture

Thinking about where you stand financially, and perhaps where you might want to be, is a very natural thing for many people. It's almost like looking at a map and trying to figure out the best route to a desired destination. When we talk about what it means to be among the wealthiest, say, the top 10 percent net worth by age, it really just brings up questions about what that looks like at different points in a person's life. This idea of financial position changes quite a bit as the years go by, and what counts as a significant amount of money at twenty-five is, of course, quite different from what it means at sixty-five.

For many, this isn't just about having a big pile of money; it's more about having a sense of security, or perhaps the freedom to make certain choices that might not be available otherwise. It's about how assets, like a home, investments, or even a retirement fund, grow over time and what those totals look like when compared to others in similar age groups. Knowing a bit about these general figures can, in a way, offer a helpful benchmark, letting you see how your own efforts stack up, or perhaps giving you some ideas for your own financial path. It's not about comparing yourself negatively, but more about getting a general sense of things.

So, we're going to explore some general ideas around what it means to be in that particular financial group, looking at how the numbers typically shift as people get older. This isn't about specific targets you must hit, but rather a look at the overall picture for those who have built up a good deal of financial holdings. It's really just a way to consider the journey of building wealth over a lifetime, and what some of the common threads are for people who find themselves in that upper tier of financial standing.

Table of Contents

- What Does Being in the Top 10 Percent Net Worth by Age Mean?

- How Does Net Worth Grow for the Top 10 Percent Net Worth by Age?

- Typical Paths for the Top 10 Percent Net Worth by Age

- Is Reaching the Top 10 Percent Net Worth by Age Possible for Everyone?

- Key Factors Influencing the Top 10 Percent Net Worth by Age

- What Financial Habits Support the Top 10 Percent Net Worth by Age?

- Looking at Different Age Groups in the Top 10 Percent Net Worth by Age

- The Importance of Planning for the Top 10 Percent Net Worth by Age

What Does Being in the Top 10 Percent Net Worth by Age Mean?

When we talk about someone being in the top 10 percent net worth by age, it simply means their total financial holdings, after subtracting any debts, place them among the highest ten out of every hundred people in their particular age group. This isn't just about how much money someone makes each year, but rather the sum of everything they own that has value, minus what they owe to others. Think of it like a snapshot of their financial standing at a certain point in time. It includes things like savings accounts, investment portfolios, real estate, and even the value of their retirement plans, less things like mortgages, car loans, or credit card balances. So, it's a measure of accumulated financial power, in a way.

The actual dollar figures for this top 10 percent net worth by age will, of course, change a great deal depending on how old someone is. A person in their twenties might be considered quite well-off with a net worth that seems small compared to someone in their fifties, because the older person has had many more years to save and invest. This distinction is really quite important because it helps us to avoid comparing apples to oranges. It's about looking at people who are more or less at the same stage in their adult lives. So, what counts as being in this group is very much tied to where you are on life's timeline.

This group often includes people who have been consistent with their saving, made smart decisions with their money, or perhaps had careers that offered good earning potential. It's not necessarily about being born into wealth, though that can certainly play a part for some. For many, it's the result of choices made over many years, like living below their means, making regular contributions to investment accounts, or paying off debts efficiently. It's a measure that reflects a certain level of financial success and, typically, a degree of financial comfort or freedom. Basically, it shows who has managed to put away a good deal of money and assets over time.

How Does Net Worth Grow for the Top 10 Percent Net Worth by Age?

The growth of financial holdings for those in the top 10 percent net worth by age typically follows a pattern that involves a combination of steady income, careful spending, and smart money placement. It's not usually a sudden jump, but more of a gradual climb over many years. A significant part of this growth comes from what people manage to save from their earnings. The more someone can put aside consistently, the more their overall financial picture can expand. This saving often starts early in their working lives, allowing for a longer period of growth.

Beyond just saving, placing that saved money into things that can grow in value is a very important step. This might mean putting money into stocks, bonds, real estate, or even starting a successful business. These sorts of holdings have the potential to increase in worth over time, sometimes quite a bit, without needing constant additional deposits from a person's paycheck. This idea, often called compounding, means that the money you've already put aside starts to earn money on its own, and that new money also begins to earn, creating a snowball effect. So, it's not just about earning a lot, but about making your money work for you.

Furthermore, avoiding or paying down debts quickly also plays a considerable part in growing one's financial standing. High-interest debts, like credit card balances, can really eat away at any money saved or earned, slowing down the overall progress. People who reach the top 10 percent net worth by age often manage their debts wisely, perhaps using loans for things that appreciate, like a home, and then working to pay those loans off. This way, more of their income can go towards building up assets rather than just paying off interest. It's a bit like making sure your financial foundation is solid before building higher.

Typical Paths for the Top 10 Percent Net Worth by Age

Looking at the usual ways people find themselves in the top 10 percent net worth by age, you often see a few common threads. Many in this group have pursued careers that tend to offer higher earnings, such as those in medicine, law, engineering, or technology, or perhaps they have found success in business ownership. These sorts of roles can provide a stronger base for saving and investing from the get-go. It's not always about having a job that pays millions, but rather one that consistently allows for a good portion of income to be set aside after living expenses are met. So, a steady, good income is a really big piece of the puzzle.

Another common approach involves a long-term commitment to saving and investing, starting as early as possible. This means consistently putting money into retirement accounts, like a 401(k) or an IRA, and also perhaps into general investment accounts. The idea here is that time is a powerful ally when it comes to growing money. The longer your money has to grow, the more it can compound and build upon itself. This consistent habit, rather than trying to get rich quickly, is often what helps people accumulate significant financial holdings over decades. It's a marathon, not a sprint, as they say.

For some, the path to being in the top 10 percent net worth by age includes owning a home and paying down its mortgage over time. A home can be a significant asset, and as the mortgage balance shrinks and the property value potentially rises, the equity in the home adds considerably to a person's net worth. Others might also use real estate as an investment, buying properties to rent out or to sell later for a gain. These kinds of property holdings can be a substantial part of their overall financial picture. It’s almost like having a savings account that also provides a place to live or an income stream.

Is Reaching the Top 10 Percent Net Worth by Age Possible for Everyone?

The question of whether everyone can reach the top 10 percent net worth by age is a bit complex, and the simple answer is that it's probably not a realistic goal for absolutely everyone. Life presents different starting points, opportunities, and challenges for each person. Factors like the type of education someone can access, the industry they work in, the economic conditions during their working life, and even unexpected personal circumstances can all play a very big part in a person's financial journey. So, while the desire to build financial security is widespread, the paths and outcomes can differ quite a lot.

However, it's also true that many of the habits and choices that contribute to being in that top group are within reach for a great many people. Things like consistently saving a portion of income, living within one's means, avoiding unnecessary debt, and learning about basic investing are practices that can benefit almost anyone, regardless of their starting point. These actions, over a long period, can lead to a much stronger financial position than if no such steps were taken. It's about making good choices with the resources you have, basically.

What's more important than aiming for a specific percentile, perhaps, is focusing on building a financial life that provides security and meets one's personal goals. For some, that might mean having enough saved for a comfortable retirement, for others it might be about owning a home free and clear, or having the ability to support their family. While the top 10 percent net worth by age represents a certain level of financial achievement, the underlying principles of smart money management are valuable for anyone looking to improve their financial situation, whatever their personal aims. It's more about progress than a particular finish line, you know?

Key Factors Influencing the Top 10 Percent Net Worth by Age

Several important elements often come together to influence whether someone reaches the top 10 percent net worth by age. One of the most significant is a person's earning potential. Higher incomes naturally provide more room for saving and investing after covering daily expenses. This isn't just about having a high-paying job, but also about the ability to grow that income over time, perhaps through promotions, changing jobs, or developing valuable skills. So, the ability to bring in more money is a pretty big deal.

Another very important factor is the habit of saving and investing consistently, and doing so early in life. The longer money has to grow through investments, the more significant the eventual sum becomes due to the power of compounding. Someone who starts putting away a small amount in their twenties will likely have a much larger sum by their fifties than someone who starts saving a larger amount in their forties, simply because of the time difference. It's almost like planting a tree; the sooner you plant it, the bigger it can get.

Financial education and smart decision-making also play a crucial role. This involves understanding how to manage debt, how different types of investments work, and how to make choices that align with long-term financial goals. People who are financially savvy are often better at avoiding pitfalls and making their money work harder for them. This doesn't mean needing a finance degree, but rather taking the time to learn the basics of personal money management. It's about being informed, basically, about your financial choices.

What Financial Habits Support the Top 10 Percent Net Worth by Age?

When we look at the financial habits that often support people in the top 10 percent net worth by age, a few common practices really stand out. One of the most fundamental is consistently spending less than they earn. This might seem simple, but it's the bedrock of building wealth. It means being mindful of expenses and making sure that a portion of every paycheck is available to be saved or invested, rather than being used up completely on current spending. This discipline is, in a way, the starting point for everything else.

Another key habit involves making saving automatic. Many people in this group set up automatic transfers from their checking accounts to savings or investment accounts each payday. This removes the need to remember to save and makes it a regular, non-negotiable part of their financial routine. It's a bit like paying yourself first, ensuring that your future financial well-being is taken care of before other expenses. This consistency, you know, really adds up over time.

Furthermore, those who achieve significant financial holdings often make deliberate choices about where their money goes. They might create a budget or a spending plan, not necessarily to restrict themselves, but to gain a clear picture of their money flow and to direct funds towards their goals. They also tend to be quite good at making their investments work for them, regularly reviewing their portfolios and making adjustments as needed. This active management, rather than just letting money sit, helps to maximize growth potential. It's about being an active participant in your financial life, really.

Looking at Different Age Groups in the Top 10 Percent Net Worth by Age

When we examine the top 10 percent net worth by age, the numbers change considerably as people get older, reflecting different stages of life and opportunities for financial growth. For younger adults, say those in their twenties or early thirties, being in this group might mean having relatively modest savings, perhaps some early retirement contributions, or a down payment on a first home. At this stage, it's more about starting good habits and getting on the right track, rather than having a huge sum of money. The focus is often on career building and initial asset accumulation, so the actual figures are, naturally, lower.

As people move into their forties and fifties, the figures for the top 10 percent net worth by age tend to grow much larger. This is often the period when careers are more established, incomes might be at their peak, and investments have had more time to compound. Many in this age group might have paid off a good portion of their mortgage, accumulated substantial retirement savings, and perhaps have other investment properties or a sizable stock portfolio. It's a time when years of consistent effort really start to show significant results, basically. The snowball effect is really kicking in here.

For those approaching or in retirement, typically from their late fifties onwards, the net worth figures for the top 10 percent are usually at their highest. By this point, many people have paid off their homes, their retirement accounts are mature, and they might have accumulated a diverse set of assets designed to provide income during their non-working years. This stage reflects a lifetime of financial planning and execution, providing a strong financial base for later life. So, it's the culmination of decades of careful money management, you know, that really shows up in these figures.

The Importance of Planning for the Top 10 Percent Net Worth by Age

Planning plays a really important part for anyone hoping to build significant financial holdings, including those aiming for the top 10 percent net worth by age. It's not just about having a general idea of saving, but about setting clear, measurable financial aims and creating a roadmap to get there. This might involve setting specific targets for retirement savings, paying off debts by a certain date, or accumulating funds for a particular purchase, like a home or a child's education. A well-thought-out plan acts as a guide, helping to keep financial efforts focused and on track, so you don't just drift along.

A good financial plan also helps people make informed decisions when unexpected situations come up or when new opportunities arise. For example, knowing your long-term goals can help you decide whether to take a new job that offers a different salary structure, or whether to invest in a particular asset. Without a plan, decisions might be made on impulse, which could potentially derail progress. It provides a framework for evaluating choices, basically, making sure they align with your bigger picture.

Furthermore, regular reviews of one's financial plan are also very helpful. Life changes, and so do economic conditions, so what made sense a few years ago might need adjusting today. This means checking in on your progress, seeing if your income or expenses have shifted, and making any necessary changes to your saving or investing strategies. This ongoing process of planning and adjustment is a hallmark of those who successfully build substantial financial holdings over time. It's a bit like tending a garden; you need to keep an eye on it to help it grow, you know?

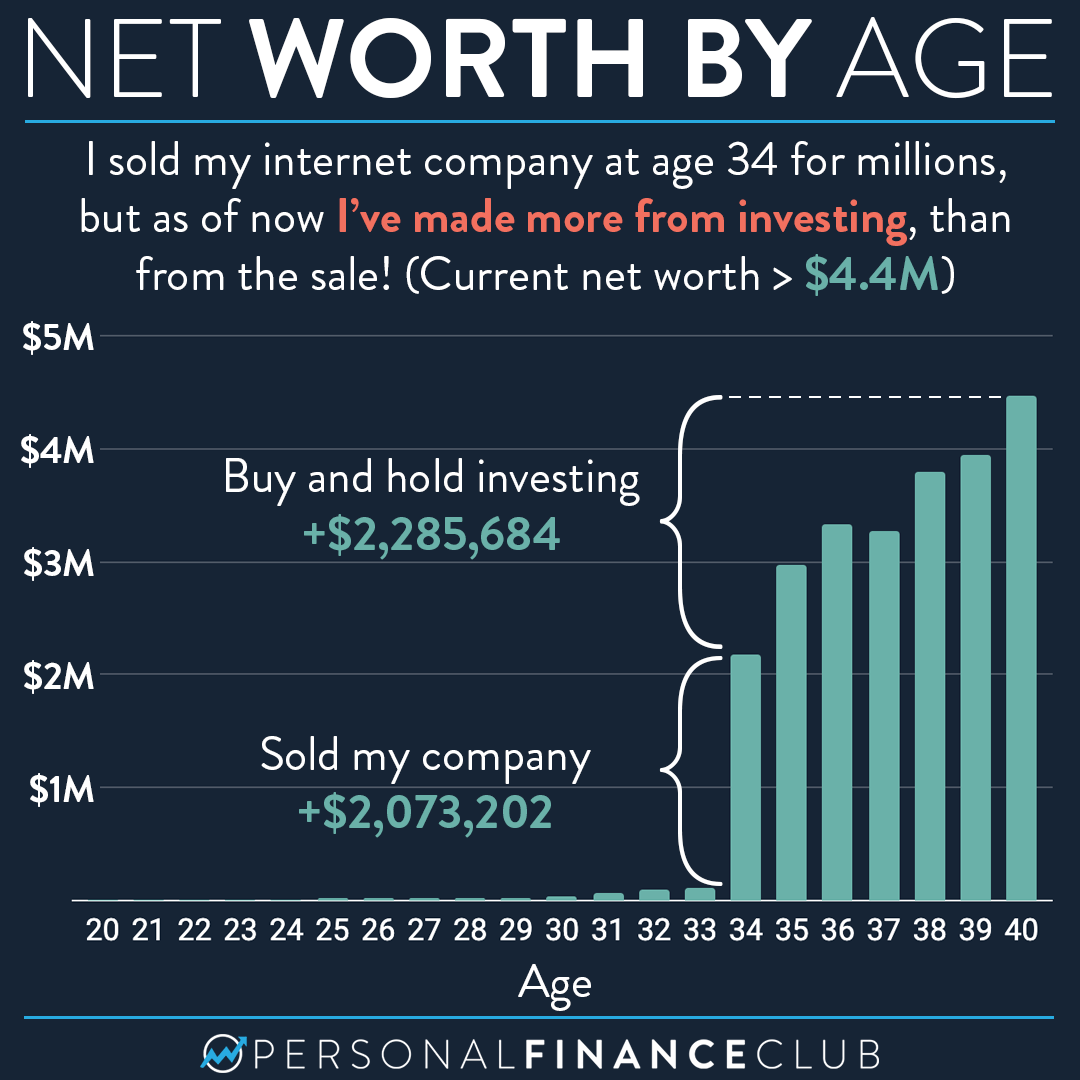

I’m a millionaire and this is my net worth by age – Personal Finance Club

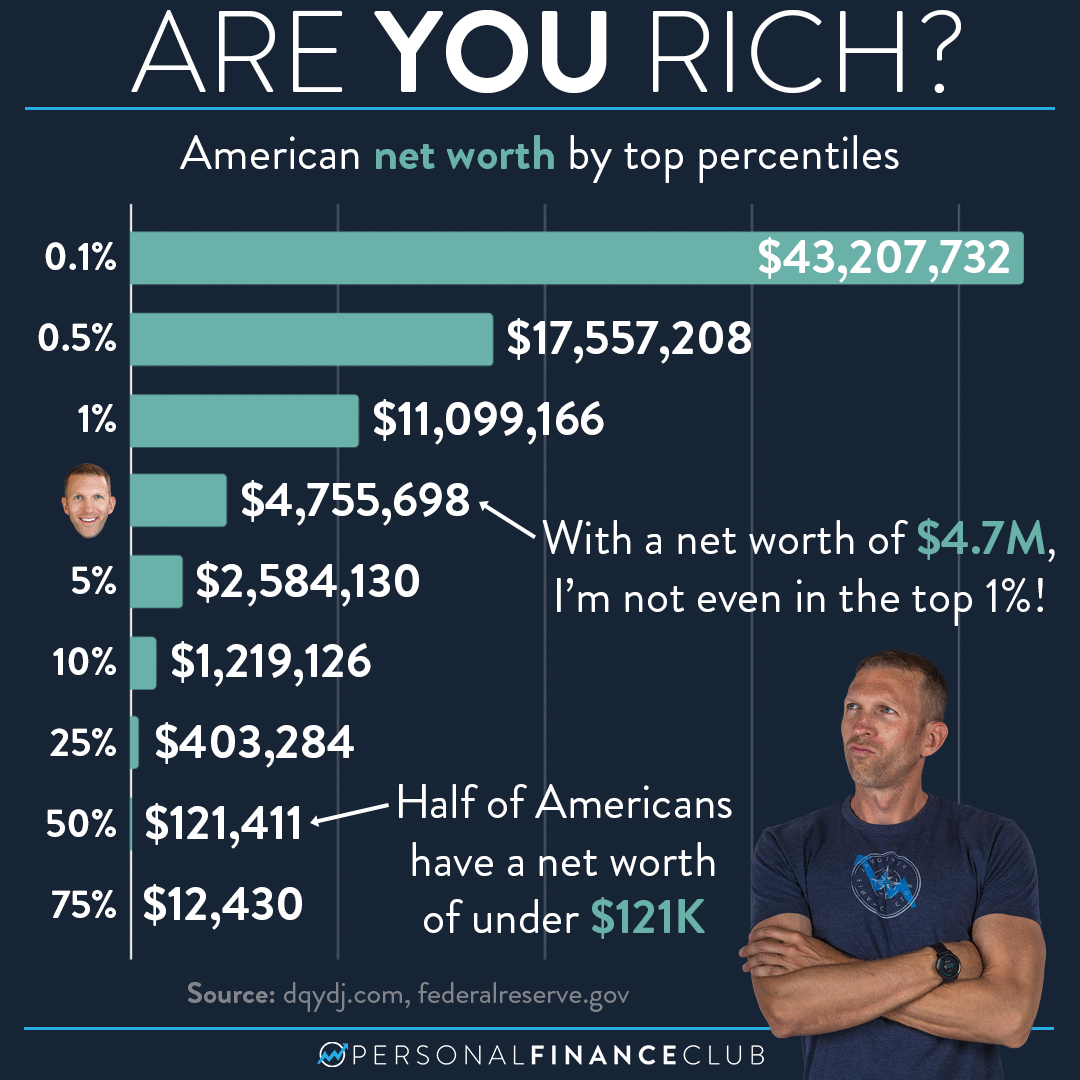

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

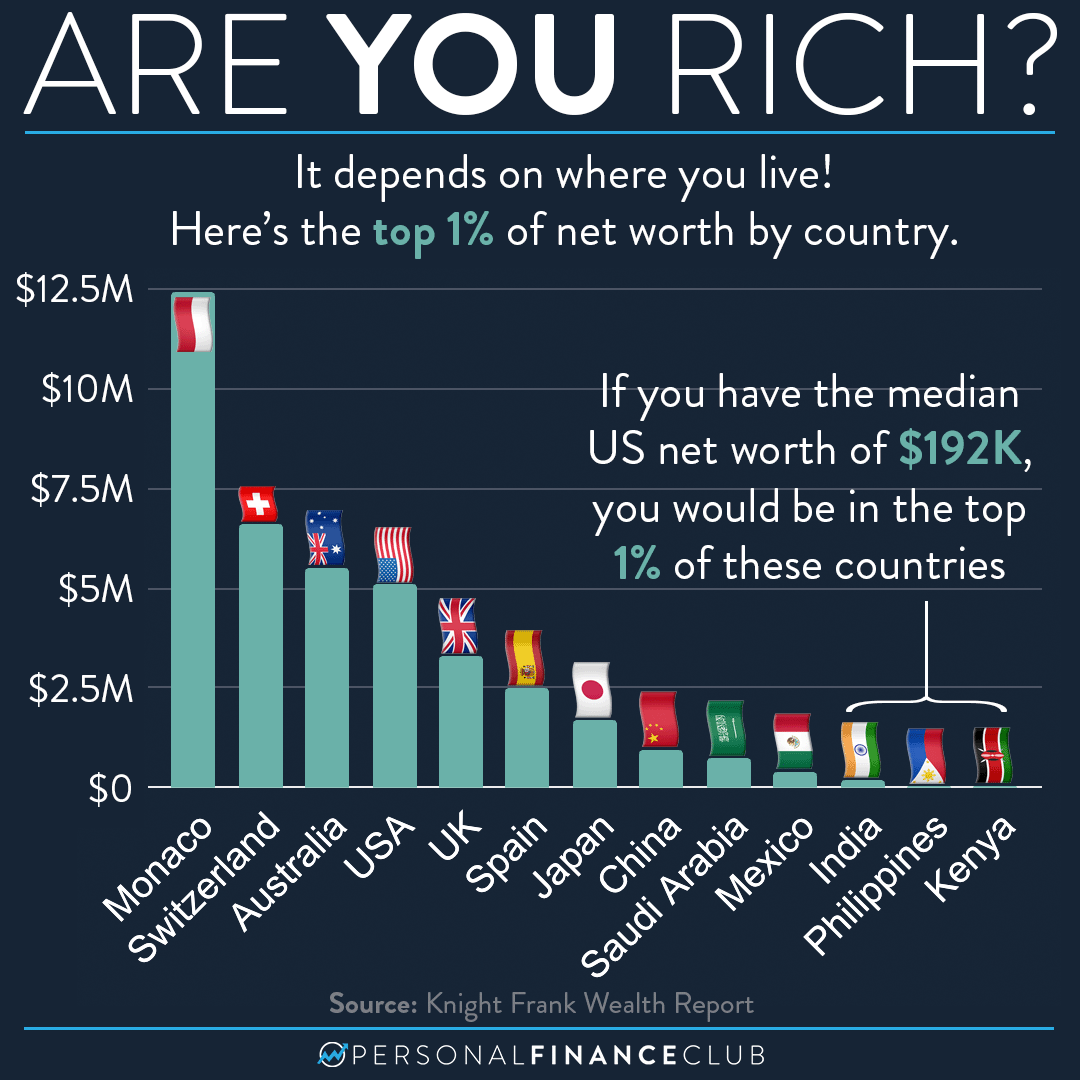

What is the top 1% of net worth by country? – Personal Finance Club