Top 0.1 Percent Net Worth - Understanding The Elite Wealth Group

Many people often wonder about the financial standing of the very wealthiest among us, a group that holds a significant amount of the world's money. It's a topic that comes up quite a bit, really, as folks try to get a sense of how wealth is spread out across society. We're talking about a tiny fraction of people who have accumulated truly immense financial holdings, something that sets them apart from nearly everyone else.

This discussion often brings up questions about what it actually means to be in this select group, what kind of money we are talking about, and how someone even gets to that point. It's not just about having a good job, you know, or saving a little here and there. The numbers involved are so much larger than what most of us deal with in our daily lives, making it a subject of considerable interest for many reasons, so.

Looking at the top 0.1 percent net worth gives us a chance to think about the different ways people build up financial resources and the various factors that play a part in such large accumulations. We can also consider, in a way, what impact this small group has on the bigger picture of the economy and how things work for everyone else, actually. It’s a pretty interesting area to explore, to be honest.

Table of Contents

- What Does It Mean to Be in the Top 0.1 Percent Net Worth?

- How Do People Reach the Top 0.1 Percent Net Worth Group?

- What Are Some Common Traits of the Top 0.1 Percent Net Worth?

- What Impact Does the Top 0.1 Percent Net Worth Have?

- Is It Possible to Join the Top 0.1 Percent Net Worth?

What Does It Mean to Be in the Top 0.1 Percent Net Worth?

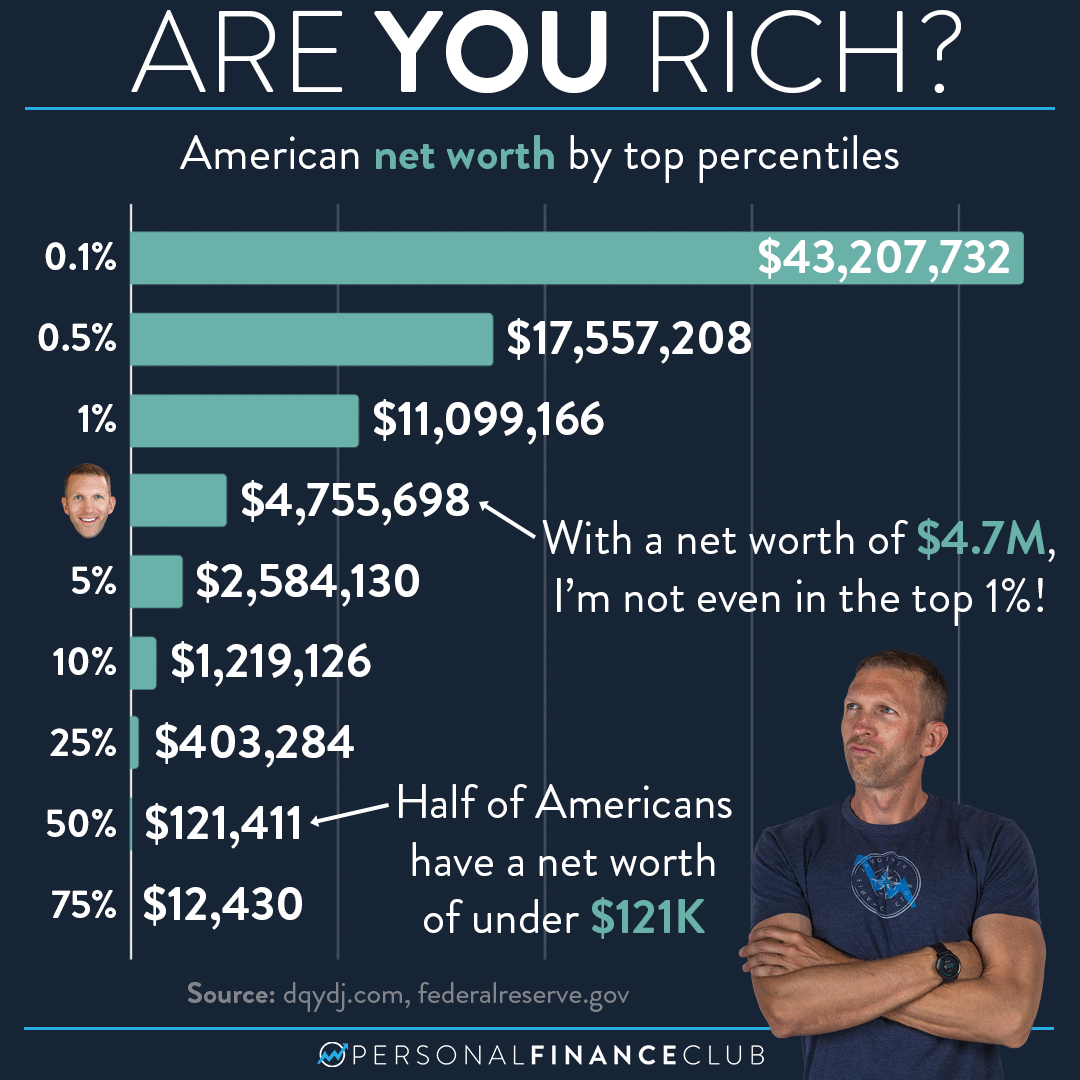

When we talk about the top 0.1 percent net worth, we are referring to a very small part of the population that holds a huge share of all the financial resources. To give you an idea, this group is even smaller than just the top one percent. It means their total financial picture, what they own minus what they owe, is higher than almost everyone else's. This level of financial standing puts them in a truly unique position, you know, in terms of their ability to make things happen with their money.

The exact amount of money needed to get into this group changes over time and depends on where you look. It's not a fixed number that stays the same year after year. Economic conditions, inflation, and how quickly wealth is growing for those at the very top all play a part in shifting that threshold. So, what might be enough one year could be a bit less the next, or a lot more, actually.

Think of it like this: if you gathered every person in a country and lined them up based on how much money they have, the people in the top 0.1 percent net worth would be right at the very, very end of that line. They represent the very peak of financial accumulation, and their wealth often comes from a mix of different sources, which we can explore a little more.

How Net Worth is Figured Out for the Top 0.1 Percent Net Worth

To figure out someone's total financial picture, or their net worth, you basically add up everything they own that has value and then take away everything they owe. This includes things like money in the bank, investments in stocks or businesses, real estate, and even valuable items like art or jewelry. On the other side, you subtract things like mortgages, loans, and any other money that needs to be paid back. It's a pretty straightforward calculation, in a way.

For those in the top 0.1 percent net worth, their financial possessions often look very different from the average person's. They might have large stakes in companies, private businesses, or complex investment funds that are not usually available to most people. Their financial obligations, while still present, are often a much smaller portion of their overall holdings, making their net total very high, you know.

The value of these holdings can change quite a bit based on how the markets are doing. For example, if the stock market goes up, the value of their investments could go up quite a lot, increasing their total financial picture. If real estate values go down, that could have the opposite effect. So, their financial standing is tied to the bigger economic picture, too it's almost.

How Do People Reach the Top 0.1 Percent Net Worth Group?

Reaching the level of the top 0.1 percent net worth usually involves more than just a regular paycheck. While earning a lot of money from a job can certainly help build financial resources, the kind of wealth we are talking about here often comes from owning things that grow in value, like businesses or big investments. It's about having capital that works for you, rather than just trading your time for money, as a matter of fact.

Many people in this group either started successful companies that grew very large, or they were early investors in businesses that became hugely valuable. Others might have inherited a significant amount of money and then managed it well, making it grow even more over time. It's typically a combination of smart decisions, a bit of good fortune, and often, access to opportunities that are not available to everyone, you know.

It's also worth noting that it's not always a quick process. For some, it might take decades of building and growing different financial ventures. For others, a single big success, like selling a company, could put them into this group quite suddenly. There are different speeds to getting there, apparently.

The Kinds of Things That Build Wealth for the Top 0.1 Percent Net Worth

The things that help build the financial picture for the top 0.1 percent net worth are typically diverse and often include a lot of different elements. A common thread is ownership of productive assets. This could mean owning a big chunk of a successful company, where the value of that ownership grows as the company does well. It's not just about owning a few shares, but often a controlling interest or a very substantial portion, obviously.

Real estate, especially large commercial properties or valuable land, also plays a big part. These properties can generate income through rent and also go up in value over time. Then there are other kinds of investments, like private equity funds, hedge funds, or venture capital, which put money into other businesses or projects with the aim of making big returns. These are generally not things the everyday person would put their money into, frankly.

Sometimes, too, intellectual property, like patents or copyrights, can be a huge source of financial accumulation, especially if it leads to a widely adopted product or service. So, it's a mix of different types of things that hold value and have the potential to grow, and these are often managed very carefully, like your own personal financial empire, you know.

What Are Some Common Traits of the Top 0.1 Percent Net Worth?

While every person in the top 0.1 percent net worth group is unique, there are some patterns or common qualities that tend to show up. Many have a strong drive to create or build something, whether that's a business, an organization, or a new way of doing things. They often have a very long-term outlook when it comes to their financial decisions, thinking years or even decades ahead rather than just about short-term gains, in other words.

They are typically very good at making decisions about money and resources. This doesn't always mean they are financial experts themselves, but they often surround themselves with advisors who are. They are also often comfortable with taking calculated risks, understanding that bigger rewards sometimes come with bigger chances. It's a mindset that allows them to pursue opportunities that others might shy away from, so.

Another common thread is a focus on continued learning and adapting. The financial landscape changes, and those who stay at the top tend to be the ones who keep up with new ideas and adjust their plans accordingly. They don't just set it and forget it; they are constantly re-evaluating, which is pretty much how things go for them.

Are There Different Paths to Being in the Top 0.1 Percent Net Worth?

Yes, there are definitely different ways people find themselves among the top 0.1 percent net worth. One path is through entrepreneurship, starting a business from the ground up and seeing it grow into something very large and valuable. This could be in technology, manufacturing, services, or pretty much any sector where a need is met in a new or better way. These folks often put in a lot of hard work and take on a lot of personal risk, as a matter of fact.

Another way is through investing, but not just in a casual sense. This involves deep knowledge of markets, a good eye for undervalued assets, and the patience to let investments mature. Some people become incredibly skilled at picking the right stocks, bonds, or private companies to put their money into, and they do this over many years, allowing their financial resources to compound significantly. It's a different kind of effort, but still very focused, you know.

Then there's the path of inheritance, where someone receives a large sum of money or valuable assets from family. However, simply inheriting money doesn't guarantee a spot in the top 0.1 percent net worth forever. Those who stay in this group often have to manage that inherited wealth wisely, making smart decisions to preserve and grow it, otherwise it could dwindle, pretty much.

What Impact Does the Top 0.1 Percent Net Worth Have?

The top 0.1 percent net worth group, by virtue of their significant financial holdings, naturally has a considerable impact on various parts of society and the economy. Their decisions about where to invest their money can shape entire industries, leading to new jobs or the decline of older ones. For example, if they decide to put a lot of money into renewable energy, that sector could see a big boost. This kind of financial activity really does make waves, so.

They also often play a role in how money flows through the system. Their spending patterns, while perhaps not as visible as everyday consumer spending, can still influence luxury markets, real estate, and certain types of services. Furthermore, their involvement in charitable giving can also be quite substantial, directing funds towards causes that they believe in, which can have a big effect on communities, too it's almost.

Beyond direct financial actions, the sheer size of their financial picture can also affect economic discussions and public policy. Questions about how much they should pay in taxes, or how their wealth is passed down, are often central to broader conversations about fairness and economic growth. It's a group that is always part of the bigger conversation, obviously.

How Does This Group Influence the Economy and Society?

The influence of the top 0.1 percent net worth on the economy and society is quite broad, extending beyond just their financial transactions. For instance, their investments in new businesses can provide the initial capital that allows innovative ideas to become real companies, creating jobs and new products. Think of a brand new technology company that gets its start because a few wealthy individuals decided to put money into it. That's a pretty direct way they shape things, you know.

They also often hold positions on the boards of large companies, foundations, or educational institutions, giving them a say in how these organizations operate and what their goals are. This kind of involvement can steer a company's direction or influence the kind of research that gets funded at a university. It's a quiet but very real kind of power, in a way.

In terms of society, their actions can sometimes set trends or influence cultural norms, especially if they are public figures. Their philanthropic efforts, for example, can draw attention to certain social issues and encourage others to contribute. So, their impact isn't just about money; it's about the broader ripples their financial standing and choices create, actually.

Is It Possible to Join the Top 0.1 Percent Net Worth?

For most people, reaching the level of the top 0.1 percent net worth is an incredibly difficult goal, if not nearly impossible, given typical circumstances. The amount of financial resources required is truly immense, far beyond what most people earn or save in their lifetimes. It typically requires a very specific combination of entrepreneurial success, significant investment returns, or a substantial inheritance, so.

However, it is certainly true that some people do move into this group from more modest beginnings. These stories often involve creating something entirely new, identifying a huge market need, or making very smart financial moves over a long period. It's not about luck alone, but often about a lot of hard work, strategic thinking, and sometimes, being in the right place at the right time with the right idea, you know.

While the odds are long, understanding how wealth is created and managed at this level can still offer valuable lessons for anyone looking to improve their own financial picture. The principles of saving, investing wisely, and building valuable skills are universal, even if the scale is vastly different, as a matter of fact.

Practical Steps for Building Your Own Wealth

Even if becoming part of the top 0.1 percent net worth seems like a distant dream, there are practical steps anyone can take to improve their own financial standing. One of the most basic things is to save a portion of what you earn regularly. Even small amounts, put away consistently, can grow over time. It's about making a habit of putting money aside before you spend it, basically.

Next, learning about investing is a really good idea. You don't need to be an expert, but understanding how different types of investments work, like stocks or mutual funds, can help your money grow faster than just keeping it in a savings account. Starting early gives your money more time to grow, which is a big advantage, you know.

Also, working on your skills and knowledge can increase your ability to earn more. Whether it's through further education, learning a new trade, or getting better at your current job, increasing your earning potential is a powerful way to build financial resources. It's about investing in yourself, which is something many financially successful people do, pretty much.

Another key step is to manage what you owe. Trying to keep debts low, especially high-interest ones like credit card balances, frees up more of your money to save and invest. It's like plugging a leak in your financial bucket. Having a clear picture of what you owe versus what you own is a good starting point for making better financial choices, too it's almost.

Finally, setting clear financial goals can help guide your decisions. Whether it's saving for a down payment on a home, planning for retirement, or building a safety net, having specific targets gives you something to work towards. These goals can help you stay on track and make smart choices with your money over the long haul, naturally.

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

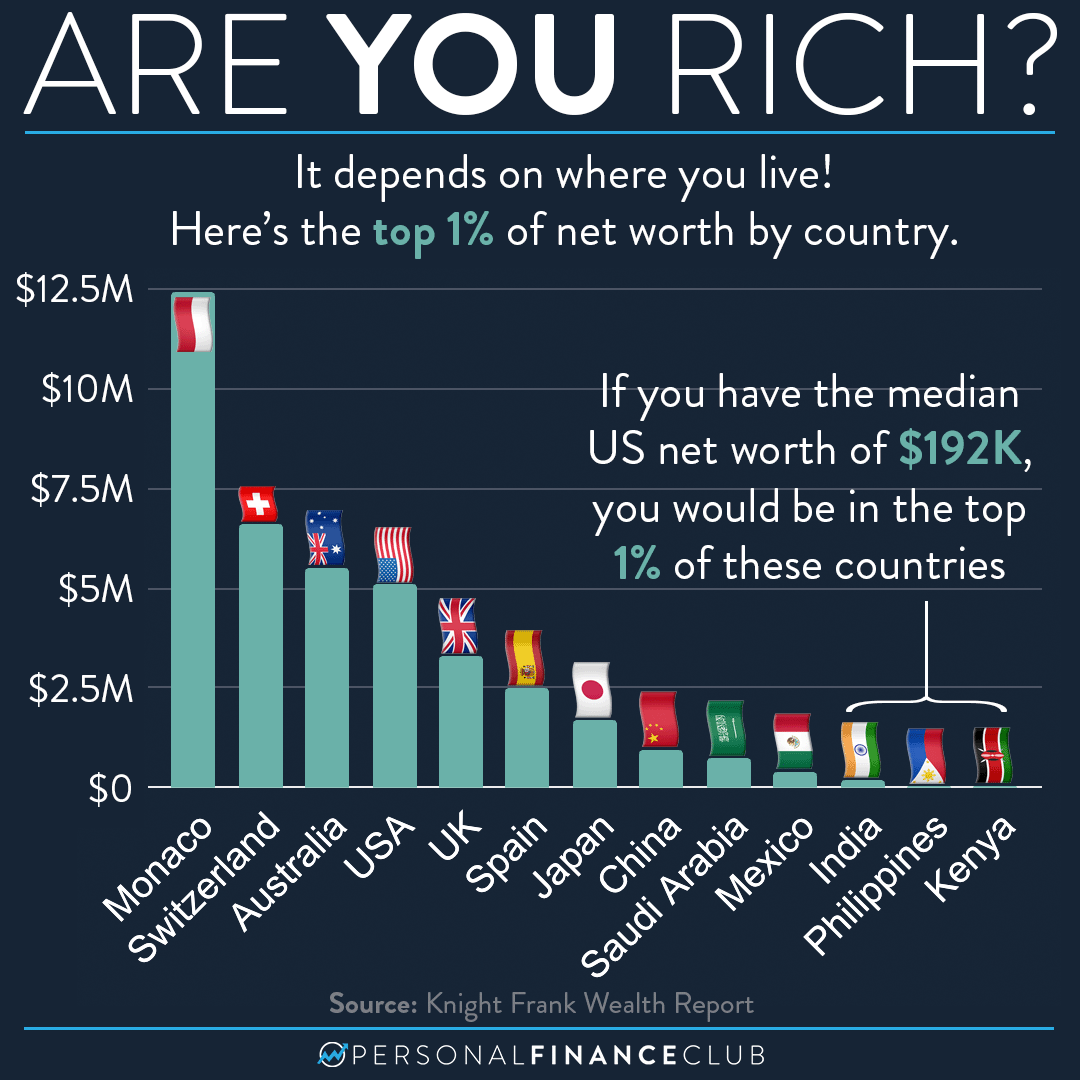

What is the top 1% of net worth by country? – Personal Finance Club

The Top One Percent’s Net Worth Is Astonishing