Top 5 Percent Net Worth By Age - What It Means

When people talk about reaching the "top" of something, they often mean getting to the very highest point, the uppermost part, or the most elevated position. This idea, really, applies to so many areas of life, including financial standing. It's not just about a mountain peak or the highest step on a ladder; it's also about a particular level of financial accumulation. For many, the notion of being in the top 5 percent of net worth is a significant marker of financial achievement, representing a considerable accumulation of assets over time, minus what is owed. This standing means someone has, in a way, reached a specific financial altitude, distinguishing their economic position from a very large portion of the population.

Understanding what it means to be among the top 5 percent financially, especially as people move through different life stages, can offer a kind of perspective. It is about more than just income; it involves a full picture of what someone possesses, like savings, investments, property, and other valuables, offset by any debts they might carry. This overall picture, you know, gives a much clearer sense of someone's economic strength than just looking at how much they earn in a year. It's a measure of accumulated financial well-being, which naturally changes and grows, or sometimes shrinks, over a person's lifetime.

People often wonder about these kinds of financial benchmarks, perhaps to see where they stand or to set goals for their own financial journeys. It’s natural to be curious about what kind of financial position others hold, especially those who have, so to speak, reached the higher echelons of wealth. This discussion will explore what it means to be in the top 5 percent in terms of net worth, looking at how this financial standing might evolve as people get older, and what general ideas might contribute to someone reaching such a position at various points in their life. It's a way to think about financial progress and the factors that shape it.

Table of Contents

- What Being in the Top 5 Percent Means

- What Does Net Worth Look Like Across Different Ages?

- Later Life and the Top 5 Percent Net Worth

- How Do People Reach the Top 5 Percent Net Worth Mark?

What Being in the Top 5 Percent Means

The Idea of the Top 5 Percent Net Worth

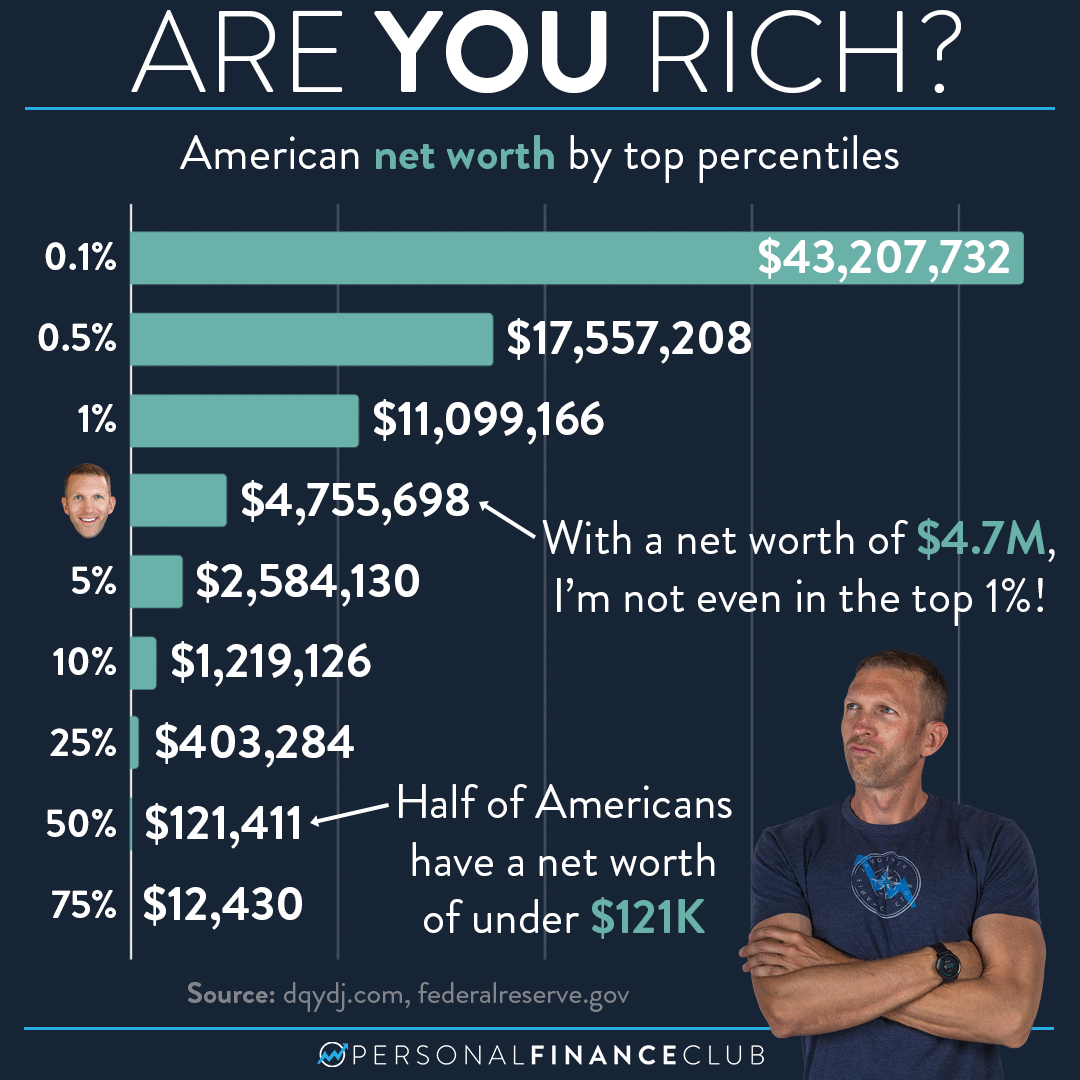

When we talk about the "top 5 percent," we are referring to a select group, those who sit at the highest part of the financial spectrum. It is, basically, the uppermost portion of individuals or households when ranked by their total financial holdings. This concept of "top" aligns with the idea of something being the highest point or the highest level, much like the top of a mountain or the top rung of a ladder. It signifies a significant accumulation of financial resources, setting this group apart from the majority. For many, this position represents a substantial level of financial security and freedom, allowing for choices and opportunities that might not be available to others. It is, in a way, a measure of success in managing and growing financial resources over time, reflecting decisions and circumstances that have led to considerable wealth accumulation. So, it's about being among those with the most significant financial standing in a given population.

How Net Worth Is Generally Measured

Net worth is, quite simply, the total value of everything you own minus everything you owe. It is a straightforward calculation that gives a snapshot of your financial standing at any given moment. What you own includes things like money in savings accounts, money in investment accounts, the value of your home, cars, and other valuable possessions. What you owe includes things like mortgages, car loans, student loans, and credit card balances. When you subtract your liabilities from your assets, the resulting figure is your net worth. It is, arguably, a more accurate representation of someone's financial health than just looking at their annual income. A person could have a very high income but also carry a lot of debt, which would mean their net worth is not as high as their income might suggest. Conversely, someone with a moderate income who saves and invests wisely over a long period can build a considerable net worth. This measure, then, truly shows the accumulated wealth, which is a rather important distinction.

What Does Net Worth Look Like Across Different Ages?

Early Years and the Top 5 Percent Net Worth

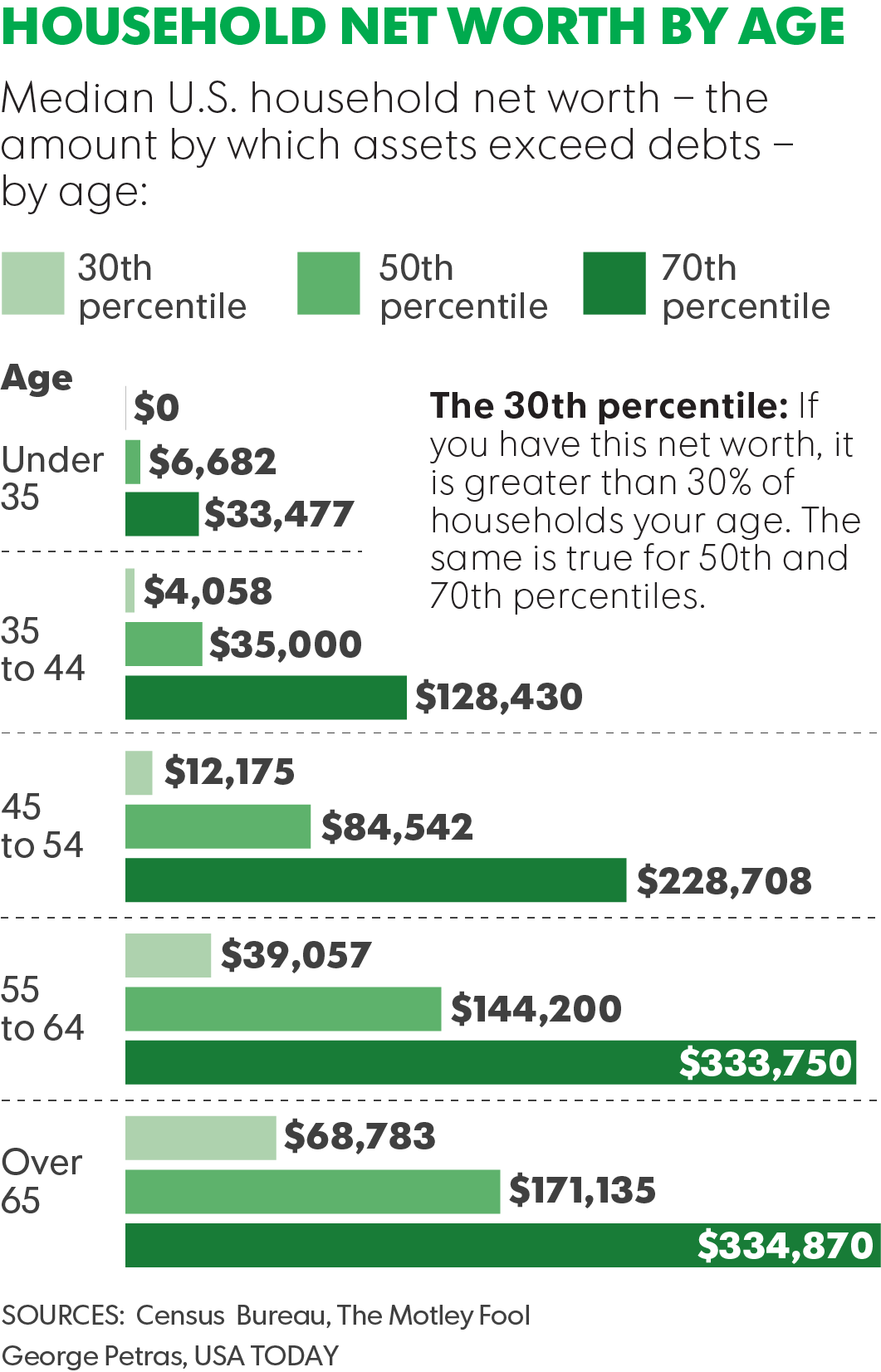

In the earlier stages of life, perhaps in one's twenties or early thirties, being in the top 5 percent net worth group is, for most people, a relatively rare occurrence. This is a time when many individuals are just starting their careers, possibly still paying off student loans, and perhaps just beginning to save for bigger life goals like buying a home. Accumulated wealth is, typically, still quite modest. Those who find themselves in the top 5 percent at these younger ages often have unique circumstances. This might include receiving a substantial inheritance, having a very early and successful venture, or working in a field with exceptionally high starting salaries and a strong savings discipline right from the start. It's not common, to be honest, for someone in their early career to have accumulated a vast amount of assets without some sort of head start or exceptional opportunity. The journey to the top 5 percent net worth, for the vast majority, really begins with small, consistent steps.

Mid-Career and Building Top 5 Percent Net Worth

As people move into their mid-career years, roughly from their late thirties through their fifties, the path to the top 5 percent net worth begins to become more discernible for some. This period often sees individuals earning higher incomes, having paid down some initial debts, and having more disposable income to put towards savings and investments. The power of compounding, where investments grow on their own earnings, starts to become quite significant over these decades. People in this age group who reach the top 5 percent often share certain habits: consistent saving, strategic investing, perhaps owning property that has appreciated in value, and making smart career moves that lead to increased earning potential. It's also a time when many might start their own businesses or take on leadership roles that come with greater financial rewards. The focus, essentially, shifts from simply earning to actively growing and protecting one's financial resources, building that overall picture of wealth. This is where, you know, consistent effort over a longer period truly starts to show results.

Later Life and the Top 5 Percent Net Worth

When people reach their later life stages, typically from their sixties onwards, the composition of the top 5 percent net worth group often changes somewhat. For many, these are the years when peak earning has passed, and the focus shifts from accumulating wealth to preserving it and, perhaps, drawing from it for retirement. Those who are in the top 5 percent at this age have usually had decades of consistent saving, investing, and often, prudent financial decisions. Their net worth might include fully paid-off homes, substantial retirement accounts, and diversified investment portfolios. It is, in a way, the culmination of a lifetime of financial choices. The goal for many in this group is to ensure their accumulated wealth can support their desired lifestyle through retirement and, for some, to leave a legacy. The financial picture at this stage is, you know, a reflection of long-term planning and the benefits of time working in their favor.

Is There a Single Path to Top 5 Percent Net Worth?

There is, honestly, no single, universally applicable path to reaching the top 5 percent net worth. The journey for each person is unique, shaped by a multitude of factors, some within their control and some not. For instance, some individuals might achieve this through a highly successful business venture, creating significant wealth in a relatively short period. Others might follow a more traditional route, diligently saving a portion of every paycheck, investing consistently over many decades, and allowing their assets to grow through market returns. Still others might benefit from significant inheritances or unexpected windfalls. The important thing is that while the end goal might be similar, the routes people take to get there can be quite different. It is, pretty much, a mix of opportunity, discipline, and sometimes, a bit of good fortune. So, you know, what works for one person might not be the exact blueprint for another.

Factors Influencing Top 5 Percent Net Worth by Age

Several factors play a significant role in determining someone's net worth at different ages, and thus, their potential to be in the top 5 percent. One key factor is, obviously, income. Higher earnings generally provide more capacity for saving and investing. However, income alone is not the sole determinant; how that income is managed is just as, if not more, important. Spending habits, for example, have a huge impact. Someone with a high income but equally high expenses might struggle to build significant net worth, while someone with a moderate income who lives below their means can accumulate substantial wealth over time. Investment choices are also very important; choosing assets that grow consistently and are diversified can greatly boost net worth. The amount of time investments have to grow, known as compounding, is also a powerful ally. Furthermore, educational background, career choices, and even geographic location can play a part. Basically, it is a combination of earning potential, disciplined financial habits, and the passage of time working in one's favor that really influences someone's standing in the top 5 percent net worth by age.

How Do People Reach the Top 5 Percent Net Worth Mark?

Reaching the top 5 percent net worth mark is, for most, a result of consistent, thoughtful actions over an extended period. It is rarely a sudden event, unless, of course, there is a very large inheritance or a significant business sale. Instead, it is typically the outcome of a steady commitment to financial well-being. This often involves making smart choices early on, such as pursuing education or skills that lead to higher earning potential, and then consistently saving a portion of those earnings. Investing those savings wisely, letting them grow through the power of compounding, and avoiding unnecessary debt are common threads among those who achieve this level of financial standing. It is, in a way, a marathon rather than a sprint, requiring patience and perseverance. People who get there often prioritize financial goals, making conscious decisions about how they earn, save, and spend their money. They tend to be proactive about their financial future, rather than just letting things happen. So, it's really about a sustained effort to build and protect wealth.

What Role Does Time Play in Top 5 Percent Net Worth?

Time plays an absolutely crucial role in building the kind of wealth that places someone in the top 5 percent net worth group. It is, perhaps, one of the most powerful elements in financial growth. The longer money is invested, the more opportunity it has to grow, not just on the initial amount, but also on the accumulated earnings. This phenomenon is often called compounding, and it means that even modest, regular contributions can grow into very substantial sums over many years. Someone who starts saving and investing early in their career, even small amounts, can often end up with a much larger net worth than someone who starts later, even if the later starter contributes more money each month. This is because the earlier contributions have more time to benefit from that compounding effect. So, the passage of time allows assets to multiply, helping individuals climb towards that top financial position. It is, you know, a very significant advantage for those who begin their financial planning early.

To sum things up, being in the top 5 percent net worth by age reflects a significant financial position, one that generally builds over time through a combination of consistent effort, smart financial decisions, and the powerful effect of long-term investing. The journey to this level of wealth is unique for everyone, shaped by individual circumstances and choices, but it always involves a careful consideration of assets and liabilities. The concept of "top" here signifies reaching an elevated financial standing, a level of accumulated wealth that sets individuals apart, offering a degree of financial freedom and opportunity that is, in some respects, quite rare.

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

Top 10 Percent Net Worth By Age 2025 - Pier Ulrica

Top 10 Percent Net Worth By Age 2025 - Pier Ulrica