Top 5 Percent Net Worth By Age - A Look

Thinking about where people stand financially, it's pretty common to wonder what it takes to be among the very best, like reaching that top spot. You know, that very idea of being at the "top" of something, like the highest point or a very elevated position, really means reaching a specific level, a kind of peak, you know? It's about being in that most elevated part, a place that is the uppermost, just like the highest rung on a ladder or the very peak of a tall hill. So, when we talk about the top 5 percent, we're looking at those who have accumulated a significant amount of financial resources, placing them in a rather distinct group when it comes to overall wealth.

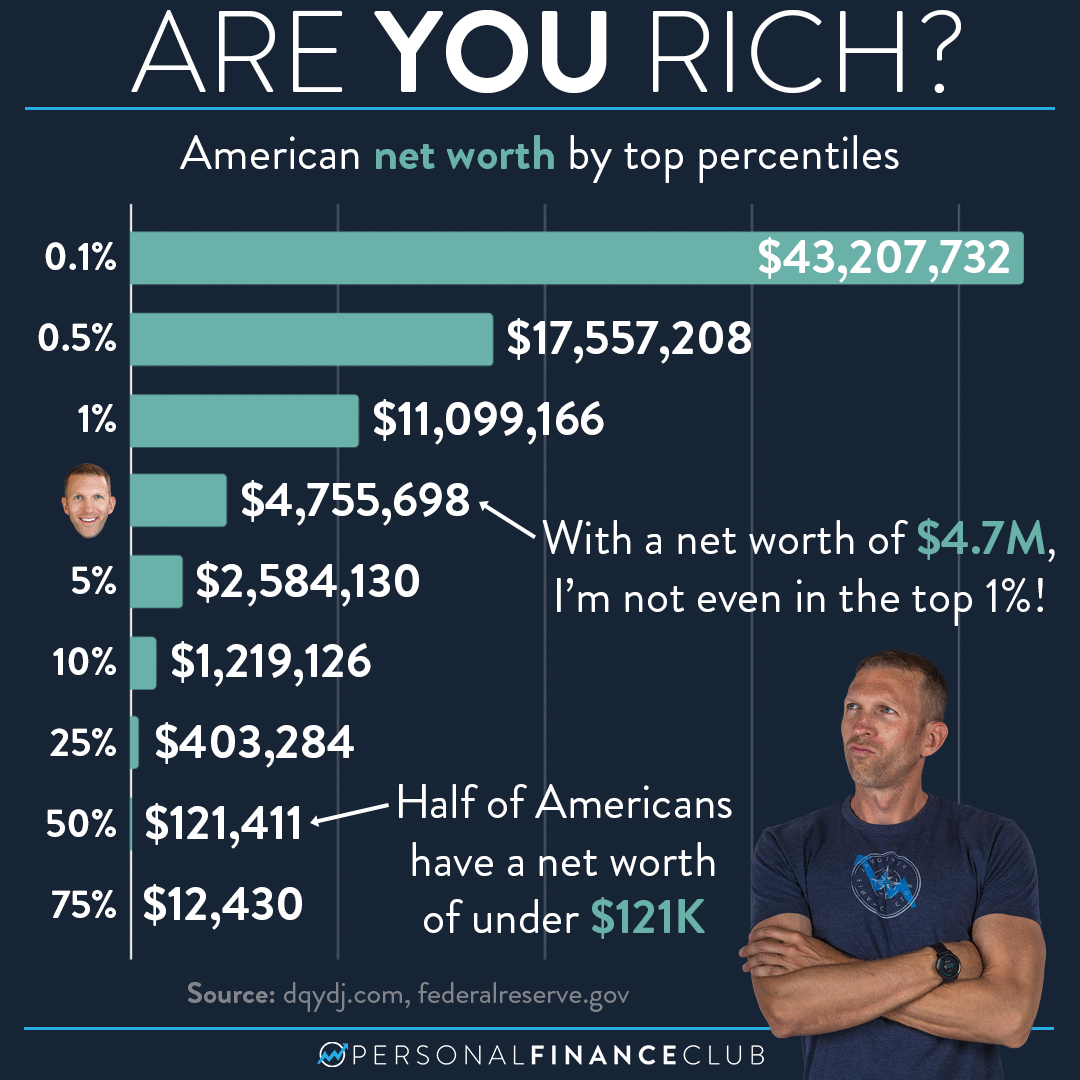

It's not just about how much someone earns in a year, though that certainly plays a part. Instead, we're talking about net worth, which is essentially what you own minus what you owe. This figure gives a much clearer picture of someone's overall financial standing. It’s like, you know, seeing the whole picture, not just a snapshot. This concept of the "top" applies here too, meaning those who possess the greatest financial value compared to almost everyone else.

People often get curious about these numbers, especially how they change as folks get older. It's interesting to observe how financial situations evolve through different life stages, from starting out with little to perhaps having a substantial amount later on. This article aims to shed some light on what it might mean to be in that top tier of wealth, looking at how it connects with different age groups, just to give you a bit of perspective on it all.

Table of Contents

- What Does Being in the Top 5 Percent Mean, Anyway?

- How Do We Even Look at Net Worth for the Top 5 Percent Net Worth by Age?

- Net Worth Milestones - What Happens as Folks Get Older?

- The Early Years - Building Up (Ages 20s-30s)

- Mid-Career Momentum - Getting Established (Ages 40s-50s)

- Approaching Retirement - Peak Accumulation (Ages 60s+)

- What Helps People Reach the Top 5 Percent Net Worth by Age?

- Is Saving Money a Big Deal for the Top 5 Percent Net Worth by Age?

- How Do Investments Play a Part in the Top 5 Percent Net Worth by Age?

- Common Paths to Higher Net Worth

- What About the Challenges?

What Does Being in the Top 5 Percent Mean, Anyway?

When someone mentions being in the "top 5 percent," it just means they are among the wealthiest 5 percent of households in a particular group, often a country. It's like being at the very uppermost part of a list, where only a few people or families manage to gather a really significant amount of money and things they own. This isn't just about how much cash is in a bank account, but rather the total value of everything a person has, like their home, investments, and retirement funds, minus any money they owe, such as mortgages or credit card bills. So, to be in this kind of elevated position, you're looking at a pretty substantial sum, which varies quite a bit depending on factors like age and where you happen to live, you know.

It's interesting to consider that the exact dollar amount needed to join this group shifts over time, as prices go up and the economy changes. What might have been a lot of money years ago could be less impressive today, so it's a moving target, basically. This is why looking at it by age can be so helpful; it gives us a better idea of what financial standing looks like for people at different points in their lives. The idea of being at the "top" here refers to that highest, most prominent position in terms of financial holdings, just like the highest point on a mountain, you know.

Reaching this level of wealth usually takes a combination of things, like earning a good income, being smart with money, and making thoughtful choices about how to save and grow assets over many years. It's not typically something that happens overnight, but rather a gradual process of building up financial strength. So, it's about consistency and a bit of foresight, too it's almost.

How Do We Even Look at Net Worth for the Top 5 Percent Net Worth by Age?

To figure out someone's net worth, you basically add up everything they own that has value – their house, any other real estate, cars, money in savings accounts, stocks, bonds, retirement funds, and even valuable collections. Then, you subtract all their debts, like their mortgage, student loans, car loans, and credit card balances. The number you get is their net worth. For the top 5 percent net worth by age, this calculation is pretty much the same, just with much larger numbers involved, naturally.

It's important to remember that net worth is a snapshot; it can change quite a bit based on market conditions, personal spending, and how much someone saves or invests. For instance, if the stock market goes down, someone's investment values might drop, and their net worth could see a temporary dip. Conversely, if property values go up, their home equity increases, adding to their net worth. So, it's a bit of a moving picture, you know.

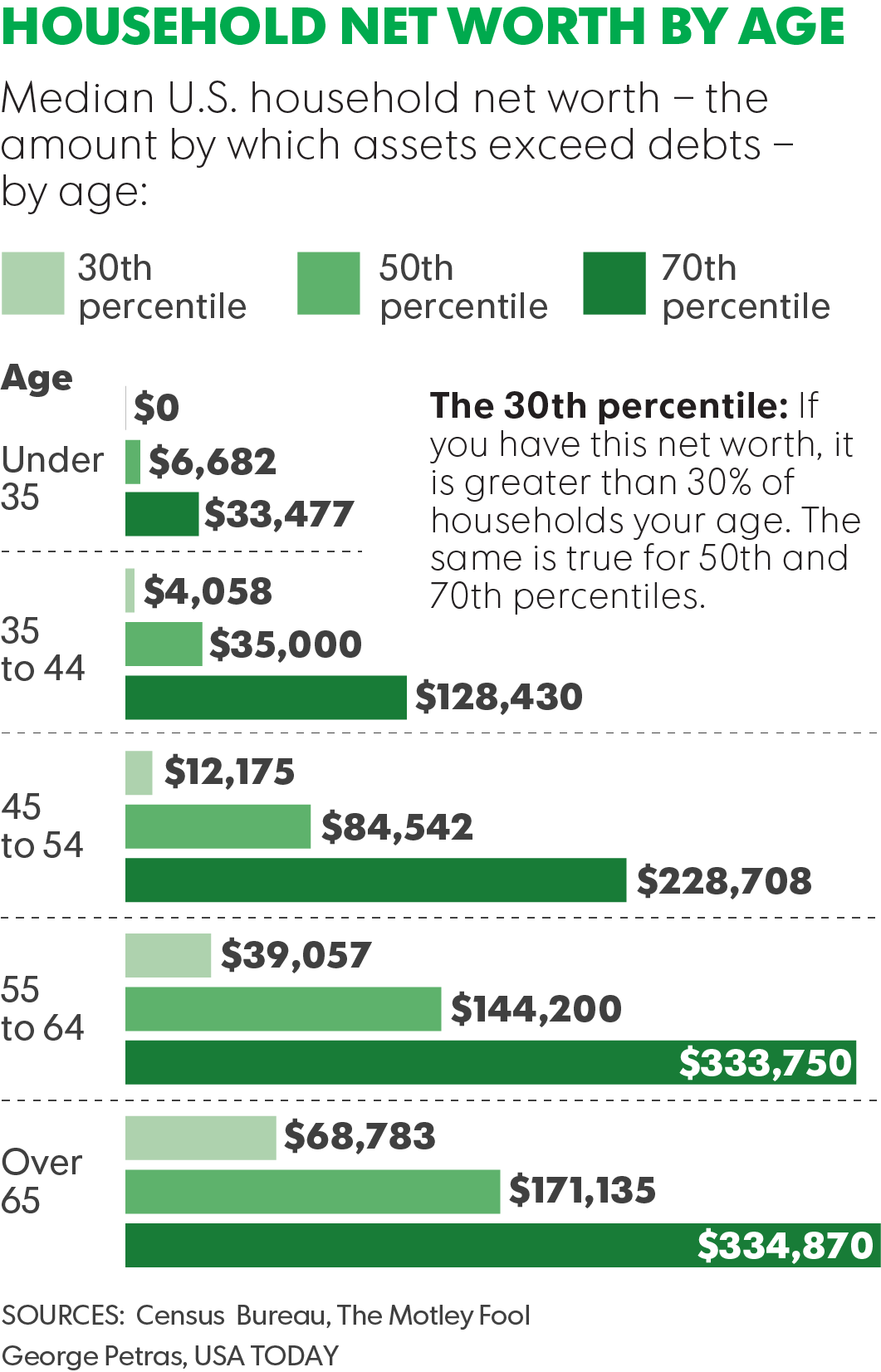

When we talk about specific age groups, the components of net worth often look a bit different. Younger people might have more student loan debt and less in investments, while older individuals might have paid off their homes and have significant retirement savings. This is why looking at the top 5 percent net worth by age gives us a more nuanced view, as it accounts for these life stage differences, just to be clear.

Net Worth Milestones - What Happens as Folks Get Older?

It's pretty interesting to see how people's financial pictures typically change as they move through different stages of life. When we look at net worth, it usually starts out fairly low for younger people, then tends to grow steadily as they get older, often reaching its highest point closer to retirement. This pattern isn't a surprise, really, as earning power often increases with experience, and there's more time to save and invest. So, you know, it's a natural progression for most people.

The path to building significant wealth, especially enough to join the top 5 percent net worth by age, involves a series of steps and choices made over decades. It’s not about hitting one big jackpot, but more about consistent effort and making smart financial decisions over a long period. For instance, putting money away regularly, even small amounts at first, can really add up thanks to the power of growth over time, you know.

Each age bracket brings its own set of financial situations and opportunities. Younger adults are often just starting out, perhaps with some debt, while those in their middle years might be balancing family expenses with increasing incomes and investment goals. Older adults, on the other hand, are typically focused on preserving their wealth and planning for their later years. It’s a pretty varied picture, actually.

The Early Years - Building Up (Ages 20s-30s)

For people in their twenties and thirties, net worth figures are often on the lower side, and for some, they might even be negative due to student loans or other starting debts. This is a time when many are just getting their careers going, perhaps buying their first home, or starting a family. The focus here is usually on establishing a solid foundation, like paying down initial debts and beginning to save for retirement. It's a pretty foundational period, you know.

Even for those aiming for the top 5 percent net worth by age, these early years are about setting the stage. This might involve choosing a career path with good earning potential, living below one's means, and making those first few investments, even if they're small. The key is to get started early, allowing time for assets to grow. So, it's really about planting seeds, in a way.

During this period, the difference between those who will eventually reach higher wealth tiers and those who won't often comes down to habits: consistent saving, avoiding unnecessary debt, and making thoughtful choices about spending. It’s about building good habits from the beginning, which can be pretty powerful over time, you know.

Mid-Career Momentum - Getting Established (Ages 40s-50s)

As people move into their forties and fifties, their earning power typically increases, and their careers are more established. This is often a period of significant wealth accumulation. Many have paid down a good portion of their mortgage, and their investments have had more time to grow. Family expenses might still be high, with children possibly in college, but there's generally more disposable income available for saving and investing. So, it's a time of real growth, in some respects.

For those in the top 5 percent net worth by age, this age range often sees a pretty big jump in their financial holdings. They might be making larger contributions to retirement accounts, investing in real estate, or expanding business ventures. The decisions made during these years can have a really big impact on their overall financial picture as they approach retirement. It’s a critical period for sure, you know.

This stage is also where the effects of earlier financial decisions become very clear. Those who started saving and investing early often see their efforts pay off significantly, as their assets have had decades to compound. It’s a pretty rewarding time for those who planned ahead, basically.

Approaching Retirement - Peak Accumulation (Ages 60s+)

For people in their sixties and beyond, this is typically when net worth reaches its highest point. Many have paid off their homes, and their retirement accounts are usually at their fullest. The focus shifts from aggressively building wealth to preserving it and planning for a comfortable retirement. This is the period where the financial efforts of a lifetime tend to truly pay off. So, it's the culmination of a lot of hard work, you know.

Those in the top 5 percent net worth by age at this stage usually have a substantial amount of assets, providing them with a significant income stream in retirement. They might be thinking about things like estate planning, how to pass on wealth, and making sure their money lasts throughout their later years. It’s a pretty comfortable position to be in, generally speaking.

It’s worth noting that even at this stage, financial planning is still important. Market fluctuations, unexpected health costs, and changes in living expenses can still impact net worth. So, while it's a peak, it still requires some attention, you know, just to keep things steady.

What Helps People Reach the Top 5 Percent Net Worth by Age?

There are several common threads that often appear when looking at people who achieve a high net worth, especially those in the top 5 percent net worth by age. It's not just one thing, but rather a combination of smart choices and consistent effort over a long time. One of the biggest factors, of course, is income. People with higher incomes generally have more money available to save and invest after covering their living expenses. This seems pretty obvious, you know.

However, a high income alone isn't enough. Many people with good salaries still struggle to build wealth if they don't manage their money well. So, it's also about how that money is handled. Things like living within or below your means, making regular contributions to savings and investment accounts, and being thoughtful about spending are really important. It’s about making your money work for you, basically.

Another key element is financial education and awareness. Understanding how investments work, the power of growth over time, and the importance of diversification can make a very big difference. Those who take the time to learn about personal finance often make better decisions that help their wealth grow. So, learning is a pretty big part of it, you know.

Is Saving Money a Big Deal for the Top 5 Percent Net Worth by Age?

Absolutely, saving money is a truly big deal for anyone hoping to build significant wealth, and it's definitely a core habit for those in the top 5 percent net worth by age. It's not just about putting away what's left over at the end of the month; it's often about making saving a priority, almost like a regular bill you pay to yourself. This means setting aside a portion of every paycheck consistently, month after month, year after year. So, it's a pretty fundamental practice, you know.

The magic of saving, especially over long periods, comes from what's called growth over time. The money you save starts to earn a little bit more money, and then that extra money also starts to earn more, and so on. This effect really makes a difference, especially when you start early. Even small, regular savings can add up to very large sums given enough time. It's a powerful force, basically.

For many who achieve higher wealth, saving is not just a habit but a disciplined approach to their finances. They might automate their savings, making sure money goes directly into a savings or investment account before they even have a chance to spend it. This kind of consistent action is a very strong foundation for building wealth, honestly.

How Do Investments Play a Part in the Top 5 Percent Net Worth by Age?

Investments play a truly crucial part in helping people reach the top 5 percent net worth by age. While saving money is important for building a base, investing is what truly helps that money grow significantly over time. It’s like, you know, making your money work harder for you, rather than just sitting still. This involves putting your saved money into things like stocks, bonds, real estate, or even starting a business, with the hope that these assets will increase in value.

The concept of growth over time is really powerful here. When you invest, your money has the chance to earn returns, and those returns can then earn more returns themselves. This is how wealth can multiply over decades, often outpacing what you could achieve through just saving in a bank account. People who reach higher levels of net worth typically understand this and use it to their advantage, really.

Diversifying investments, meaning spreading your money across different types of assets, is also a pretty common strategy. This helps to reduce risk, as not all investments perform the same way at the same time. By making smart, long-term investment choices, individuals can significantly boost their net worth and move closer to, or maintain, that top 5 percent standing. So, it's a very strategic element, you know.

Common Paths to Higher Net Worth

There are several common paths that people often take to build substantial net worth. One very clear route is through a high-paying career, particularly in fields like medicine, law, technology, or finance. These professions often offer salaries that allow for significant savings and investment after covering living expenses. It’s a pretty direct way to get a good income, you know.

Another significant path is entrepreneurship. Starting and growing a successful business can lead to a very large increase in wealth, especially if the business becomes very valuable or is sold for a high price. This route often involves more risk and hard work, but the potential rewards can be much greater than a traditional salary. So, it's a more adventurous approach, basically.

Real estate investment is also a popular way to build wealth. Buying properties, either to rent out or to sell for a profit, can generate both income and appreciation in value over time. Many people who reach higher net worth levels have a portion of their wealth tied up in real estate. It’s a pretty tangible asset, you know.

Lastly, consistent, disciplined saving and investing, regardless of the specific career path, is a universal factor. Even with a moderate income, someone who consistently saves a significant portion of their earnings and invests it wisely over many decades can accumulate substantial wealth. It's about the long game, really.

What About the Challenges?

Building significant net worth, even for those aiming for the top 5 percent net worth by age, is not without its challenges. Life has a way of throwing unexpected things our way, and these can sometimes put a dent in financial plans. Things like sudden job loss, unexpected health issues, or major family emergencies can require dipping into savings or taking on new debt. So, it's not always a smooth road, you know.

Market downturns are another big challenge. When the stock market drops, the value of investments can go down, sometimes quite a bit. While these are often temporary, they can be unsettling and might require a bit of patience to ride out. It’s like a temporary setback, basically, but it can feel pretty significant at the time.

Inflation, which is when the cost of goods and services goes up over time, can also erode the purchasing power of money, meaning your money buys less than it used to. This is why investing is so important, as it helps money grow faster than inflation, but it's still something to keep in mind. So, it's a constant consideration, you know.

Maintaining financial discipline over many years is also a challenge. It's easy to get sidetracked by desires for immediate gratification or succumb to lifestyle creep, where spending increases as income rises. Staying focused on long-term financial goals requires a good deal of self-control and consistent effort. It's a bit of a marathon, really.

This article has explored what it means to be in the top 5 percent net worth by age, looking at how net worth is calculated and how it typically changes across different life stages. We've considered the early years of building a foundation, the mid-career period of significant growth, and the peak accumulation phase closer to retirement. The discussion also touched upon key factors that help people achieve higher net worth, such as consistent saving and smart investing, and acknowledged some of the common challenges that can arise along the way.

US Net Worth By Top Percentiles Breakdown – Personal Finance Club

Top 10 Percent Net Worth By Age 2025 - Pier Ulrica

Top 10 Percent Net Worth By Age 2025 - Pier Ulrica